ABIDJAN, Côte d’Ivoire – Though the current growing conditions in West Africa favours the prospects of a good crop for the forthcoming 2022/23 cocoa season, the observed spike in prices of farm inputs, especially fertilizers, is likely to generate some negative effects on cocoa production.

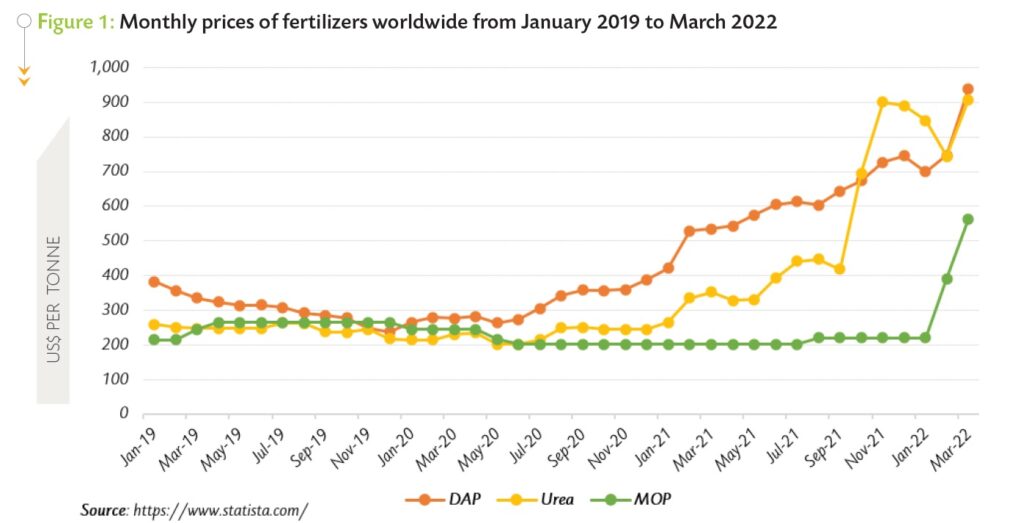

As shown in Figure 1, although prices of the three types of fertilizers which are mostly used in cocoa farms followed an upward trend, they skyrocketed to reach their highest levels over the 3-year period (January 2019 – March 2022).

Indeed, the prices of di-ammonium phosphate (DAP) strengthened by 26% from US$747 per tonne in February 2022 to US$938 per tonne in March 2022. Meanwhile, the prices of urea and muriate of potash (MOP) soared by 22% from US$744 to US$908 per tonne and by 44% from US$392 to US$563 per tonne respectively.

The proper and sufficient use of fertilizers in cocoa farms is instrumental in the development of the crop in cocoa-growing regions, particularly in Africa where the botanical stocks of cocoa trees are aging, producing low yields, and prone to cocoa-related diseases.

The proper and sufficient use of fertilizers in cocoa farms is instrumental in the development of the crop in cocoa-growing regions, particularly in Africa where the botanical stocks of cocoa trees are aging, producing low yields, and prone to cocoa-related diseases.

Given the weak purchasing power of smallholding cocoa farmers, an increase in the prices of fertilizers is likely to lead to a reduction in the use of fertilizers in cocoa farms and thereby result, in the mid to long-term, in a decline in the yield, quality and size of the crop.

Furthermore, the steep increase in fertilizers prices will likely make them less affordable for cocoa producers and provoke a change in their economic behaviour which is not extricable at this stage.

At this junction, one could argue that the increase in fertilizer prices, which is an input of paramount importance in cocoa cultivation, could lead cocoa farmers to re-allocate the amount of money intended for other expenses, such as children’s schooling or access to healthcare for household members, to buy fertilizers.

Should this scenario occur, school dropout rates in cocoa-growing communities could substantially increase due to a lack of financial ressources to cover schooling expenses and therefore, further expose children to the child labour phenomenon in cocoa plantations.

Another scenario to be envisaged is farmers abandoning cocoa farming in favour of more remunerative crops or activities such as illegal mining. Aside from these two scenarios, another potential change in the farming practices of cocoa farmers could be that they will continue to use fertilizers on their farms either in below-normal or normal quantity per tree, but only on a part of their farms. The near future will reveal further insights in relation to high input prices such as fertilizers.

Size of cocoa beans stocks in exchange licensed warehouses in Europe and the United States

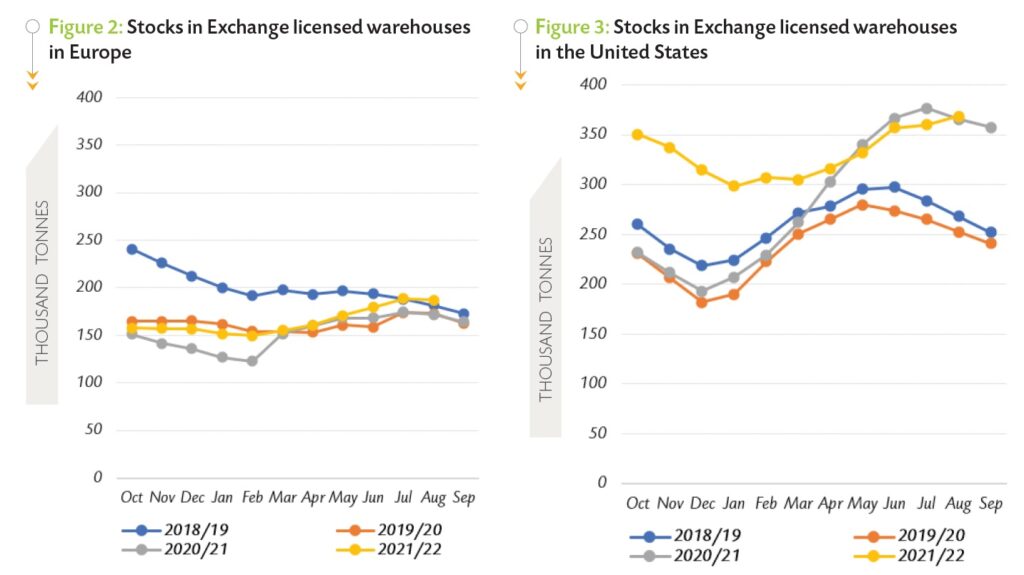

Figure 2 and Figure 3 show that at this stage of the 2021/22 cocoa year, total stocks of cocoa beans in Exchange licensed warehouses are higher year-over-year on both sides of the Atlantic.

At the end of August 2022, total stocks in Exchange licensed warehouses in Europe amounted to 187,035 tonnes, up by 9% compared to the volume of 171,869 tonnes seen a year ago.

In a similar vein, stocks of cocoa beans in licensed warehouses in the United States were up by 1% to 368,589 tonnes year-on-year. The current high level of stocks in Exchange licensed warehouses could signal relatively ample carryover stocks of cocoa beans at the end of 2021/22 crop year which is drawing to a close.

Moreover, the share of certified stocks of cocoa beans in August 2022, i.e. volumes of cocoa ready to be tendered against a matured futures contract is by far larger in Europe (80% or 150,413 tonnes) compared to the United States (11% or 40,521 tonnes) thereby indicating that while the London cocoa futures market is mainly for hedging activities, its equivalent in New York is mostly for speculative operations.

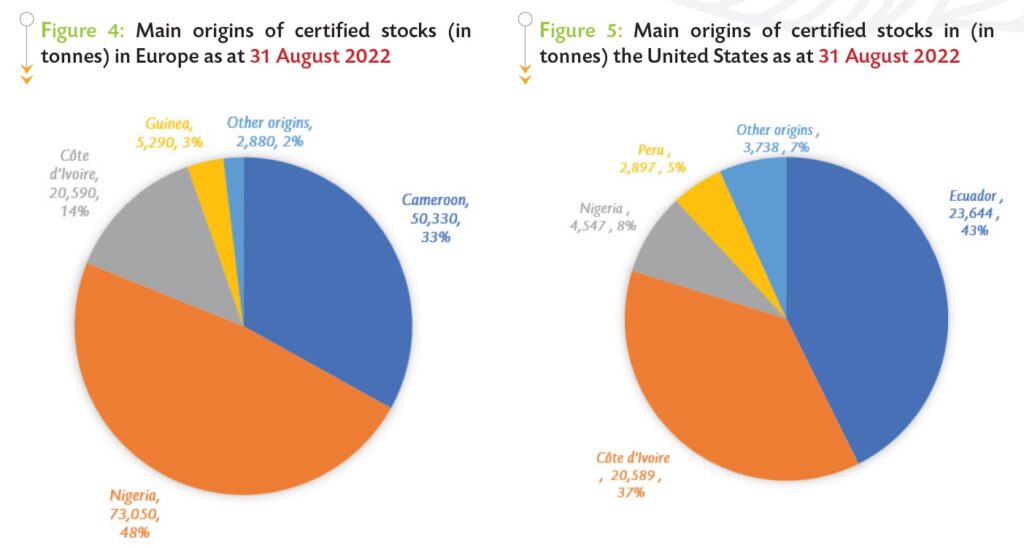

At the beginning of the 2021/22 cocoa year, the ICE Futures Europe (London market) modified the rules governing the grading of cocoa lots on the Exchange by introducing a discount (in British Pound per tonne) on lots of cocoa for which the initial grading certificate came to expiry. This modification in the grading rules in Europe has been followed by the publication of an end-of-month report containing the breakdown by origin of the composition of certified stocks of cocoa beans held in the ICE Futures Europe licensed warehouses. It should be noted that the breakdown of certified stocks of cocoa beans was already reported on a daily basis on the ICE Futures U.S. (New York market).

At the beginning of the 2021/22 cocoa year, the ICE Futures Europe (London market) modified the rules governing the grading of cocoa lots on the Exchange by introducing a discount (in British Pound per tonne) on lots of cocoa for which the initial grading certificate came to expiry. This modification in the grading rules in Europe has been followed by the publication of an end-of-month report containing the breakdown by origin of the composition of certified stocks of cocoa beans held in the ICE Futures Europe licensed warehouses. It should be noted that the breakdown of certified stocks of cocoa beans was already reported on a daily basis on the ICE Futures U.S. (New York market).

Based on data published in the above-mentioned reports, at the end of August 2022, certified stocks of cocoa beans held in European Exchange licensed warehouses originated mainly from Nigeria (48% or 73,050 tonnes), Cameroon (33% or 50,330 tonnes), Côte d’Ivoire (14% or 20,590 tonnes) and Guinea (3% or 5,290 tonnes) (Figure 4). In the United States (Figure 5), certified stocks are made of cocoa beans coming mainly from Ecuador (43% or 23,644 tonnes), Côte d’Ivoire (37% or 20,589 tonnes), Nigeria (8% or 4,547 tonnes), and Peru (5% or 2,897 tonnes). Cocoa beans stocks in Europe Exchange warehouses are mainly made of African origins while in the United States, certified stocks of cocoa beans mostly originate from neighboring Latin American countries.

Futures prices developments

Futures prices developments

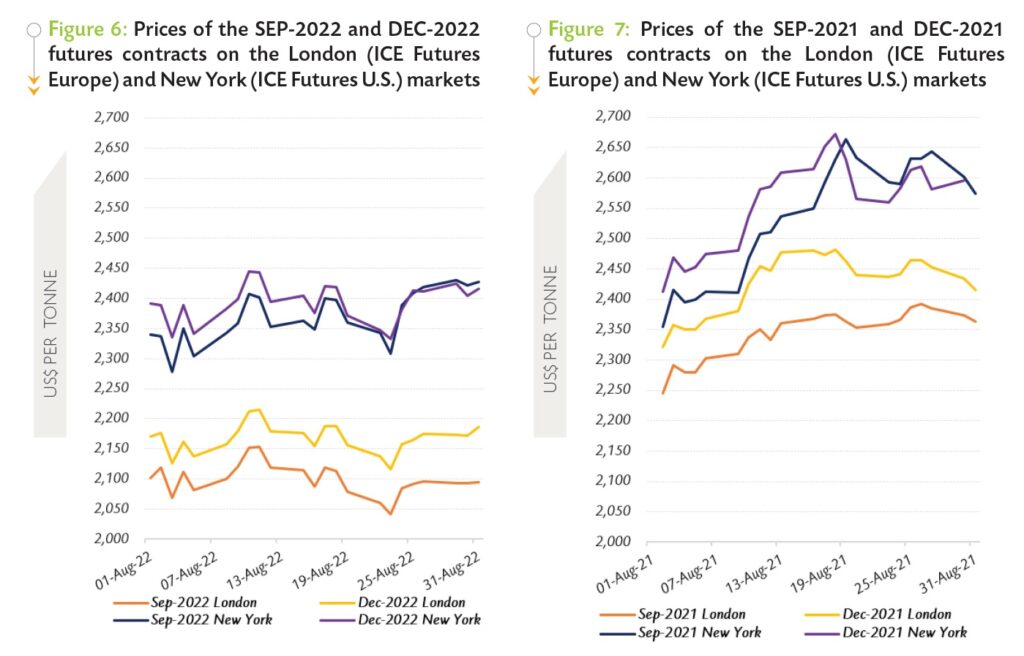

During August 2022, prices of the front-month cocoa futures contract averaged US$2,100 per tonne and ranged between US$2,041 and US$2,154 per tonne in London, while in New York the first position contract traded at an average price of US$2,369 per tonne and oscillated between US$2,278 and US$2,430 per tonne.

A year back i.e., in August 2021, prices were higher and the average price of the front-month contract settled at US$2,343 per tonne and ranged between US$2,245 and US$2,392 per tonne in London. Meanwhile, prices of the first position of cocoa futures in New York averaged US$2,534 per tonne and oscillated between US$2,355 and US$2,664 per tonne.

Figure 6 shows the price movements of the first and second positions on the London and New York futures markets respectively at the London closing time in August 2022, while Figure 7 presents similar information for the previous year.

Despite the initial decline observed at the beginning of August (Figure 6), prices of the SEP-22 contract developed upward on both sides of the Atlantic during the first ten (10) days of the month under review. Indeed, prices of the front-month firmed by 2% from US$2,102 to US$2,152 per tonne and by 3% from US$2,340 to US$2,407 per tonne in London and New York respectively.

Various factors were at play during this period. On the one hand, cumulative arrivals of cocoa beans at Ivorian ports as well as volumes of purchases of graded and sealed cocoa beans in Ghana were lower year-over-year. Indeed, as at 7 August, cumulative arrivals of cocoa beans in Côte d’Ivoire were reported at 2.034 million tonnes, down by 3.6% compared to the volumes recorded during the corresponding period of the previous season.

In addition, over the period October 2021 – July 2022, domestic grindings in Côte d’Ivoire totalled 529,000 tonnes, representing a 15% increase year-on-year compared to 461,000 tonnes ground over the same period of the previous season.

In Ghana, cocoa production for the 2021/22 season reported a decline to reach a 12-year low at 689,000 tonnes Moving on to 11-24 August, trends were reversed and prices plunged on both the London and New York markets.

In London, prices declined by 3% moving from US$2,154 to US$2,084 per tonne while in New York, they went slightly down from US$2,401 to US$2,389 per tonne. This downturn trend in prices was an aftereffect of concerns that rising prices of energy in Europe together with a steady climb in the inflation rates could curb cocoa demand in the region.

However, prices reverted from their descent towards the end of the month under review on both sides of the Atlantic and ended the month on a positive note during the last five (5) trading days. In London, prices averaged US$2,094 per tonne and ranged between US$2,091 and US$2,095 per tonne, while in New York, the average settlement price stood at US$2,421 per tonne, with a minimum of US$2,408 per tonne and a maximum of US$2,430 per tonne.

At the time, market participants were envisaging a larger-than-expected surplus deficit for the 2021/22 cocoa year.

Summary of the global supply and demand forecasts for the 2021/22 season

At the end of August, the revised forecasts for the 2021/22 cocoa season published by the ICCO Secretariat in its latest issue of the Quarterly Bulletin of Cocoa Statistics (QBCS) suggested a supply deficit of 230,000 tonnes. Global production is expected to decrease by 6.8% to 4.890 million tonnes.

Production is projected to drop by almost 9.9% to 3.655 million tonnes in Africa, whereas in the Americas as well as in Asia and Oceania, crop output is anticipated to increase by 3.6% to 969,000 tonnes and by 5.1% to 266,000 tonnes respectively. At the time of writing (as at 7 September), cumulative arrivals of cocoa beans at Ivorian ports amounted to 2.072 million tonnes, down by 4.1% year-on-year.

Inversely, grindings are expected to expand to 5.071 million tonnes, up by 73,000 tonnes, representing a 1.5% increase compared to the revised estimate of 4.998 million tonnes for the 2020/21 cocoa season. It is envisaged that processing activities will expand by 2.2% to 1.847 million tonnes in Europe, whereas a growth of 3.9% to 1.091 million tonnes is projected for Africa.

In the Americas, processing activities are forecast to depress by 0.8% to 966,000 tonnes while in Asia and Oceania, grindings are anticipated to be flat at 1.167 million tonnes compared to the level attained during the previous season.