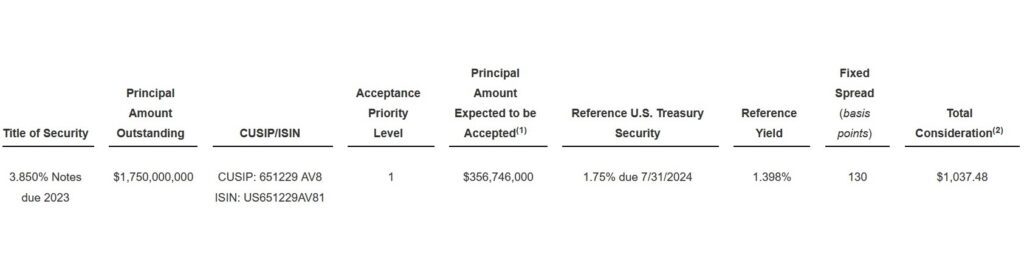

HOBOKEN, N.J., U.S. — Newell Brands Inc. announced yesterday the pricing terms of its previously announced tender offer to purchase for cash up to $356,746,000 aggregate principal amount (the “Maximum Waterfall Tender Amount”) of the Company’s outstanding 3.850% Notes due 2023 (the “2023 Notes”), 4.000% Notes due 2022 and 4.200% Notes due 2026 (collectively, the “Waterfall Notes”), subject to the Acceptance Priority Levels as defined below (such offer, the “Waterfall Offer”).

The Company also announced the principal amount of each series of Waterfall Notes that it expects to accept for purchase pursuant to the Waterfall Offer. The Waterfall Offer is being made upon and is subject to the terms and conditions set forth in the Offer to Purchase, dated August 12, 2019 (the “Offer to Purchase”).

The Total Consideration (as defined in the Offer to Purchase) for each series of Waterfall Notes is payable to holders of the Waterfall Notes who validly tendered and did not properly withdraw their Waterfall Notes at or prior to 5:00 p.m., New York City time, on August 23, 2019 (the “Waterfall Early Tender Deadline”) and whose Waterfall Notes are accepted for purchase by the Company.

The Reference Yield listed in the table below was determined at 10:00 a.m., New York City time, on August 26, 2019 (the “Waterfall Price Determination Date”) by the lead dealer managers. Payments for Waterfall Notes purchased in connection with the Waterfall Early Tender Deadline will also include accrued and unpaid interest from and including the last interest payment date applicable to the relevant series of Waterfall Notes up to, but not including, the early settlement date for such Waterfall Notes accepted for purchase, which is currently expected to be August 27, 2019 (the “Waterfall Early Settlement Date”).

(1) Expected to be accepted for purchase, and paid for, on the Waterfall Early Settlement Date.

(1) Expected to be accepted for purchase, and paid for, on the Waterfall Early Settlement Date.

(2) The Total Consideration payable for each $1,000 principal amount of Waterfall Notes validly tendered at or prior to the Waterfall Early Tender Deadline and accepted for purchase by us includes an early tender premium of $50. In addition, holders whose Waterfall Notes are accepted will also receive accrued interest on such Waterfall Notes.

As previously announced, because the aggregate principal amount of validly tendered Waterfall Notes as of the Waterfall Early Tender Deadline exceeded the Maximum Waterfall Tender Amount, Waterfall Notes will be purchased subject to the Maximum Waterfall Tender Amount, the acceptance priority levels (the “Acceptance Priority Levels”) and proration as described in the Offer to Purchase. Accordingly, and as listed in the table above, the Company expects to accept for purchase, and pay for, $356,746,000 aggregate principal amount of its 2023 Notes on a prorated basis on the Waterfall Early Settlement Date. The Company will use a proration rate of approximately 34.11% for the 2023 Notes. 2023 Notes validly tendered at or prior to the Waterfall Early Tender Deadline will be multiplied by such proration rate and then rounded down to the nearest $1,000 increment.

Although the Waterfall Offer is scheduled to expire at midnight, New York City time, at the end of September 9, 2019, unless extended or terminated (the “Waterfall Expiration Date”), because the Waterfall Offer was fully subscribed as of the Waterfall Early Tender Deadline, the Company does not expect to accept for purchase any Waterfall Notes tendered after the Waterfall Early Tender Deadline. Holders of Waterfall Notes who validly tender such notes following the Waterfall Early Tender Deadline and at or prior to the Waterfall Expiration Date will only receive the applicable Tender Offer Consideration for such Waterfall Notes accepted for purchase, which is equal to the applicable Total Consideration minus an early tender premium of $50. Waterfall Notes not accepted for purchase will be promptly returned or credited to the holder’s account. The withdrawal deadline of 5:00 p.m., New York City time, on August 23, 2019 has passed and, accordingly, Waterfall Notes validly tendered in the Waterfall Offer may no longer be withdrawn except where additional withdrawal rights are required by law.

The Company does not currently intend to call for redemption the Waterfall Notes not tendered and accepted for purchase in the Waterfall Offer.

Newell Brands’ obligation to accept for payment and to pay for the Waterfall Notes validly tendered in the Waterfall Offer is subject to the satisfaction or waiver of the conditions described in the Offer to Purchase.

Barclays Capital Inc. and RBC Capital Markets, LLC are serving as the Lead Dealer Managers, and HSBC Securities (USA) Inc. is serving as Co-Dealer Manager, in connection with the Waterfall Offer. The information agent and tender agent is Global Bondholder Services Corporation. The full details of the Waterfall Offer, including complete instructions on how to tender Waterfall Notes, are included in the Offer to Purchase. Holders are strongly encouraged to read carefully the Offer to Purchase, including materials incorporated by reference therein, because they contain important information. Copies of the Offer to Purchase are available at https://www.gbsc-usa.com/newellbrands/ and requests for copies may also be directed to the information agent at (212) 430-3774 (banks and brokers) or (866) 807-2200 (all others). Questions regarding the Waterfall Offer should be directed to Barclays Capital Inc., Liability Management Group, at (212) 528-7581 (collect) or (800) 438-3242 (toll free) or RBC Capital Markets, LLC, Liability Management Group, at (212) 618-7843 (collect) or (877) 381-2099 (toll free).

None of the Company or its affiliates, their respective boards of directors, the dealer managers, the information agent and tender agent or the trustees with respect to the Waterfall Notes is making any recommendation as to whether holders should tender in response to the Waterfall Offer, and neither the Company nor any such other person has authorized any person to make any such recommendation. Holders must make their own decision as to whether to tender any of their Waterfall Notes, and, if so, the principal amount of Waterfall Notes to tender.

This news release shall not constitute an offer to sell, a solicitation to buy or an offer to purchase or sell any securities. The Waterfall Offer is being made only pursuant to the Offer to Purchase and only in such jurisdictions as is permitted under applicable law.