PITTSBURGH & CHICAGO, U.S. — The Kraft Heinz Company (Nasdaq: KHC) (“Kraft Heinz” or the “Company”) today reported preliminary financial results for the first half of 2019 that reflected lower net sales despite improving consumer takeaway trends in key markets, as well as the adverse impacts of ongoing cost inflation, greater investments, and higher depreciation and amortization expenses.

Results also included preliminary non-cash impairment charges related to goodwill and intangible assets that more than offset a one-time gain on the sale of the Company’s India nutritional beverages business.

“The level of decline we experienced in the first half of this year is nothing we should find acceptable moving forward,” said Kraft Heinz CEO Miguel Patricio.

“We have significant work ahead of us to set our strategic priorities and change the trajectory of our business. But in my short time with the company, I have developed a strong appreciation for the affinity consumers around the world continue to have for our brands, the talent and determination of our employees, as well as the commitment of our customers. We have a lot to work with and build upon, and our team is motivated by the opportunity to drive the next phase of growth and profitability for Kraft Heinz and our shareholders.”

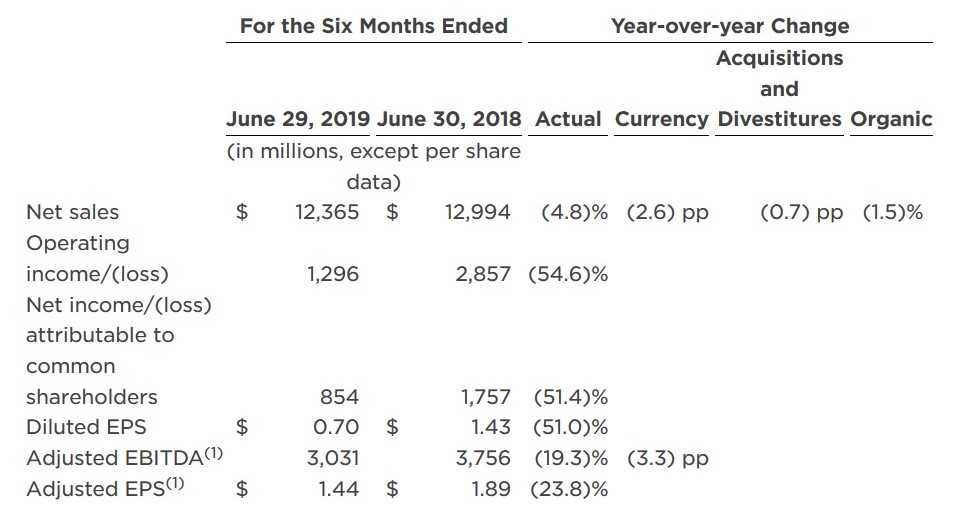

For the six months ended June 29, 2019, net sales were $12.4 billion, down 4.8 percent versus the year-ago period, including an unfavorable 2.6 percentage point impact from currency and a net 0.7 percentage point negative impact from acquisitions and divestitures. Organic Net Sales decreased 1.5 percent versus the year-ago period. Pricing was down 1.3 percentage points versus the prior year period, primarily reflecting unfavorable promotional timing in North America, as well as price reductions to reflect lower key commodity costs in the United States.

For the six months ended June 29, 2019, net sales were $12.4 billion, down 4.8 percent versus the year-ago period, including an unfavorable 2.6 percentage point impact from currency and a net 0.7 percentage point negative impact from acquisitions and divestitures. Organic Net Sales decreased 1.5 percent versus the year-ago period. Pricing was down 1.3 percentage points versus the prior year period, primarily reflecting unfavorable promotional timing in North America, as well as price reductions to reflect lower key commodity costs in the United States.

This more than offset higher pricing in certain Rest of World markets. Volume/mix decreased 0.2 percentage points as unfavorable changes in retail inventory levels in North America and lower shipments in EMEA and Rest of World markets more than offset solid consumption growth in the United States and Canada.

In connection with the preparation of the first and second quarter financial statements, which occurred concurrently due to the delayed filing of the 2018 Form 10-K, the Company concluded that the fair values of certain goodwill and intangible assets were below their carrying amounts.

As a result, the Company recorded non-cash impairment charges to lower the carrying amount of goodwill in certain reporting units (EMEA East, Brazil, United States Refrigerated, and Latin America Exports) by approximately $744 million, primarily based on new five-year operating forecasts for several international businesses that establish revised expectations and priorities for the coming years in response to current market factors.

In addition, the Company recorded non-cash impairment charges of approximately $474 million to lower the carrying amount of certain intangible assets, primarily driven by the application of a higher discount rate to reflect the markets’ perceived risk in the Company’s valuation.

Net income attributable to common shareholders decreased to $854 million and diluted EPS decreased to $0.70, primarily reflecting a $0.89 negative impact from non-cash impairment charges, as well as lower Adjusted EBITDA. Adjusted EBITDA decreased 19.3 percent versus the year-ago period to $3.0 billion, including a negative 3.3 percentage point impact from currency.

Excluding the impact of currency, the reduction in Adjusted EBITDA reflected lower organic net sales, higher supply chain costs, and spending behind strategic initiatives. Adjusted EPS decreased 23.8 percent to $1.44, as a combination of lower Adjusted EBITDA and higher depreciation and amortization expenses more than offset lower taxes on adjusted earnings versus the prior year period and higher other income.