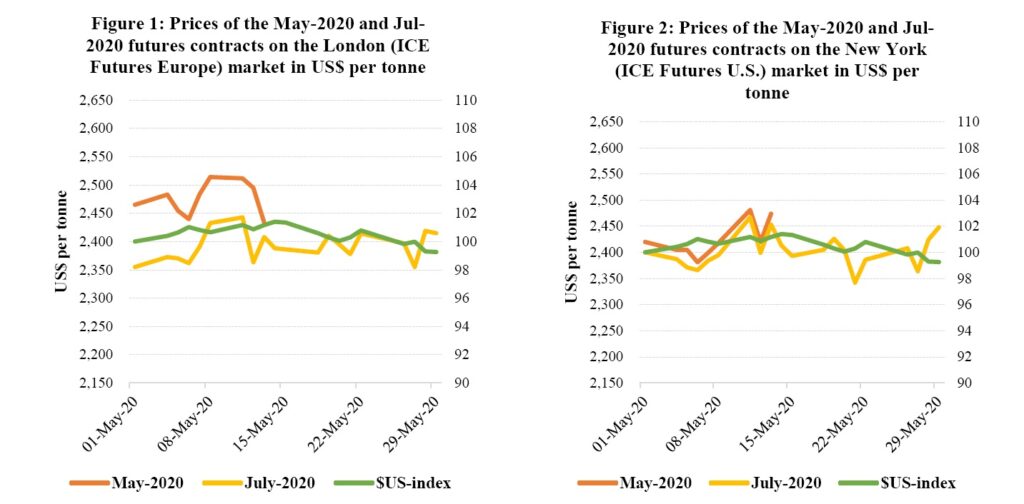

ABIDJAN, Côte d’Ivoire – This review of the cocoa market situation focuses on the prices of the May-2020 and Jul-2020 futures contracts listed on ICE Futures Europe (London) and ICE Futures U.S. (New York) during the month of May 2020. It aims to highlight key insights on expected market developments and the effect of the exchange rate on the US-denominated prices of the said contracts.

Figure 1 shows the development of the aforementioned futures contracts prices on the London cocoa market whilst Figure 2 depicts the evolution of prices for the same futures contracts on the New York market at the London closing time.

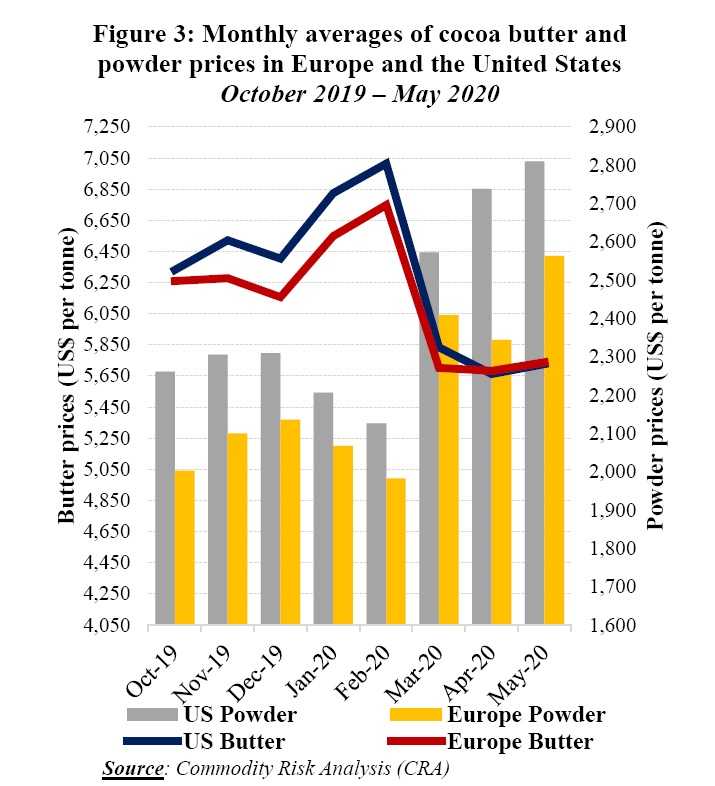

Hence, by monitoring the development of the US dollar index in May, one can determine the impact of the US dollar exchange rate on the development of the futures prices during the period under review. Figure 3 presents monthly averages of cocoa butter and powder prices in Europe and the United States since the start of the 2019/20 crop year.

Price movements

During May, the front-month cocoa futures contracts prices averaged US$2,431 per tonne and see-sawed between US$2,355 per tonne and US$2,514 per tonne in London (Figure 1). Concurrently in New York, prices for the first position of cocoa futures contracts averaged US$2,411 per tonne and oscillated between US$2,342 per tonne and US$2,481 per tonne (Figure 2).

Both futures markets were in backwardation – more pronounced in London – and experienced volatility. Over the period 1-13 May, prices of the May-2020 contract averaged US$2,476 per tonne and ranged between US$2,434 per tonne and US$2,514 per tonne in London. In New York, prices of the front month contract averaged US$2,423 per tonne and ranged between US$2,381 per tonne and US$2,481 per tonne.

At the time, market participants were envisaging potential disruptions in the shipments of cocoa beans following the Ivorian Government’s announcement to extend the state of emergency in the country to curb the spread of the coronavirus pandemic.

Furthermore, cumulative arrivals of cocoa in Côte d’Ivoire were seen at 1.784 million tonnes, down by 5.7% compared to the 1.891 million tonnes recorded the year before; whilst in Ghana, purchases of graded and sealed cocoa were established at 698,493 tonnes, down by 0.9% compared with levels reached during the same period of the previous season.

At the expiry of the May-2020 contract on 13 May, the adjustment in the price of the nearby futures contract in London was more abrupt than in New York because of the high premium. Despite uncertainties which stemmed from the plausible burden of the coronavirus pandemic on the global commodity market including cocoa, prices of the first position cocoa contract increased slightly by 1.1% from US$2,388 to US$2,415 per tonne in London and by 1.5% from US$2,413 to US$2,448 per tonne in New York.

At the same time, cumulative port arrivals in Côte d’Ivoire decreased year-on-year and the US dollar depreciated by approximately 1%. Hence, the slight improvement seen on cocoa prices was mostly fuelled by current movements

Figure 3 shows that compared with the average prices recorded at the start of the 2019/20 cocoa year, prices for cocoa butter plunged during May in both Europe and the United States, the world’s largest cocoa consuming markets. Indeed, prices for cocoa butter plummeted by 10% from US$6,331 to US$5,727 per tonne in the United States, while in Europe they declined by 8%, moving from US$6,260 to US$5,739 per tonne.

Compared to the levels reached in October 2019, prices for cocoa powder substantially rose on both markets, increasing by 24% from US$2,261 to US$2,810 per tonne in the United States. During the same time frame in Europe, powder prices rose by 28% from US$2,003 to US$2,564 per tonne.

In addition, compared to their average values recorded at the start of the 2019/20 cocoa year, the nearby cocoa futures contract prices increased slightly by 0.3% from US$2,423 to US$2,431 in London at the end of May 2020. Conversely, in New York, the frontmonth contract prices shrunk by 2.3% from US$2,467 to US$2,411 per tonne over the same period.

Supply and demand situation in the cocoa market

Cocoa production in Côte d’Ivoire continues to lag further behind the record level reached during the 2018/19 crop year. Indeed, as at 7 June 2020, cumulative cocoa arrivals, since the start of the 2019/20 crop season, were seen at 1.881 million tonnes, down by 6.9% from 2.021 million tonnes reached during the same period a year earlier.

In Ghana, the Ghana Cocoa Board (COCOBOD) published data showed that Ghanaian graded and sealed cocoa for the 2019/20 crop year decreased by 1.6% year-on-year to reach 714,523 tonnes on 15 May 2020.

The recent forecasts for the 2019/20 cocoa season published by the ICCO Secretariat in its latest issue of the Quarterly Bulletin of Cocoa Statistics reveal anticipations of a lower growth in grindings compared to the previous cocoa season.

Grindings are expected to reduce to 4.783 million tonnes, down by 78,000 tonnes. This lower forecast reflects that the coronavirus pandemic is undermining demand in the usual mature markets (Europe and North America) as well as Asia (the continent that is reputed for witnessing stronger growth in processing activities).

It is projected that processing activities will increase by 5% to 1.201 million tonnes in Asia and Oceania whereas a growth of 0.5% to 1.022 million tonnes is anticipated in Africa.

On the contrary, in the Americas, processing activities are forecast to contract by 3% to 873,000 tonnes while a 2% decline to 1.687 million tonnes is envisaged in grindings activities for Europe as compared to the level attained in the same period of the previous season.