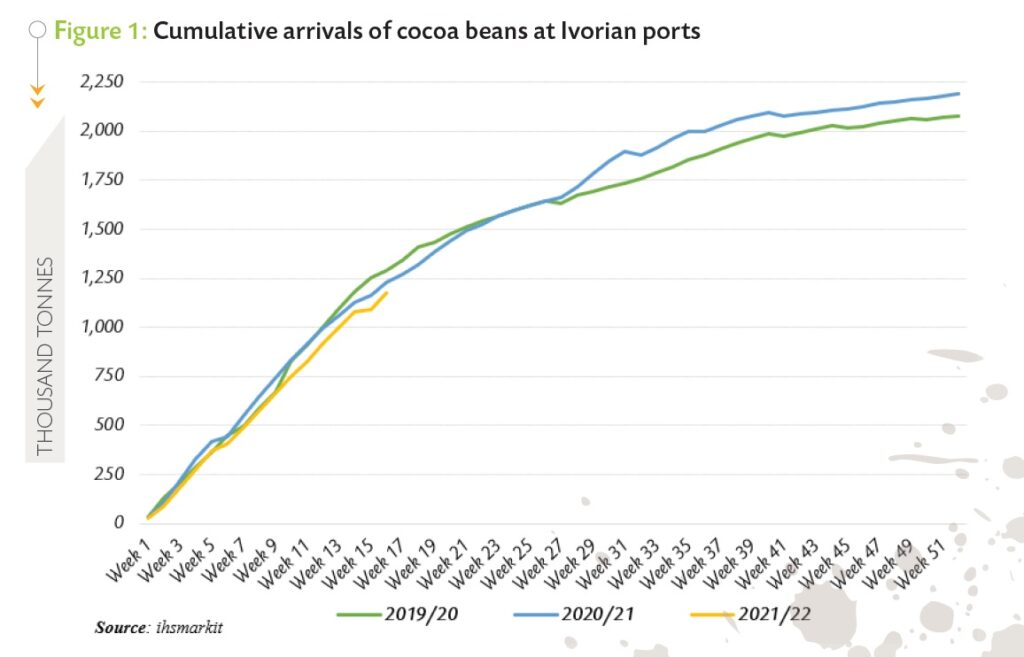

ABIDJAN, Côte d’Ivoire – The adequate temperature and rainfall together with the mild Harmattan recorded in the previous months anticipated a good crop for the 2021/22 season, says the ICCO in its cocoa report for December 2021. Notwithstanding that, arrivals and purchases of cocoa beans from the two-top producing countries were reported to be down by 4% in Côte d’Ivoire (Figure 1), and a staggering 54% in Ghana.

At this stage, it is unknown whether, we are in presence of a poor season or other factors are affecting the evacuation of beans from upcountry. According to Le Conseil du Café-Cacao, since the beginning of the 2021/22 season, arrivals at ports reached 1.178 million tonnes as at 16 January 2022, down from 1.227 million tonnes recorded a year ago.

In Ghana, purchases of graded and sealed cocoa beans for the 2021/22 cocoa year as at 6 January 2022 were reported at 263,000 tonnes, down from 570,000 tonnes recorded a year earlier.

Also, exports of cocoa beans from Cameroon are reported to be lower than expected. It is for now unclear whether internal constraints are slowing down the evacuation of cocoa beans from upcountry, reports the ICCO.

Bullish markets on demand optimism

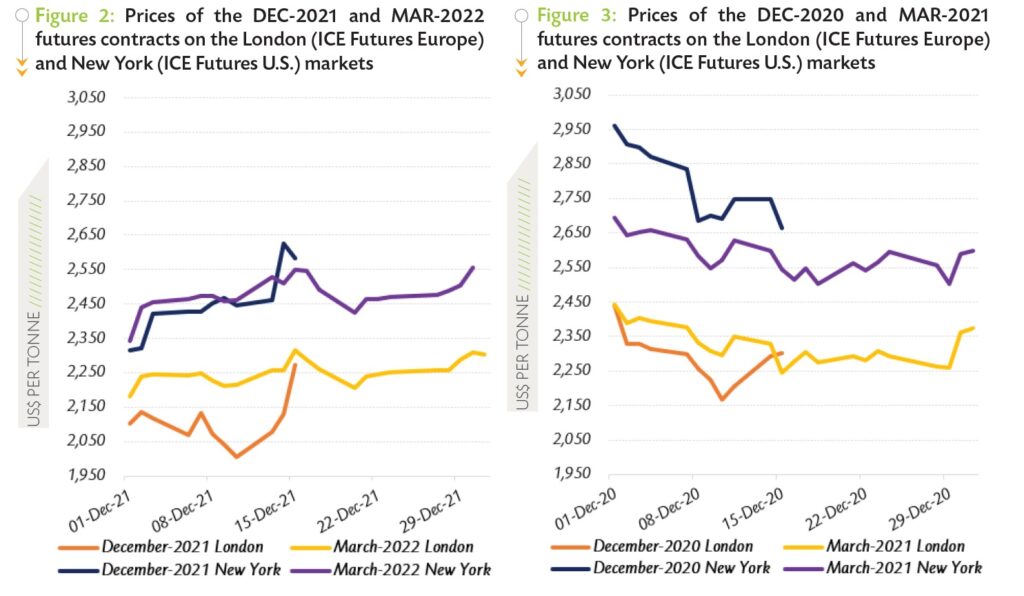

An overall positive trend was observed in the prices of the December 2021 (DEC-21) and March 2022 (MAR-22) cocoa futures contracts during December 2021, says the ICCO. This trend was fuelled by the optimism on demand for cocoa products, in at least the mid-term, and the low year-on-year arrivals recorded in main cocoa producing countries in Africa.

Figure 2 shows price movements on the London and New York futures markets respectively at the London closing time in December 2021, while Figure 3 presents similar information for the previous year.

Figure 2 indicates that, before reaching its expiration date (15 December), the DEC-21 contract generally traded at lower prices compared to the deferred one (MAR-22) on both sides of the Atlantic. In London, the front-month contract (DEC-21) was priced at US$135 per tonne cheaper compared to the MAR-22 contract whereas in New York, an average discount of US$19 per tonne was applied on prices of the DEC-21 contract compared to the MAR-22 one.

Back in December 2020, Figure 3 outlines that futures markets presented different configurations with the London one being in contango while in New York, cocoa futures market was in a pronounced backwardation.

It is worth noting that the contrasting market configurations observed a year ago in both London and New York was an aftereffect of the Exchange of Futures for Physical (EFP) that occurred in New York, thus creating a strong market tension over the DEC-20 contract.

During the month under review, the MAR-22 contract priced stronger on both the London and New York markets.

This was due to the anticipation of improvements in the demand; and the year-on-year lower arrivals of cocoa beans in main cocoa producing countries. Hence, compared to their settlement values recorded during the first trading day of December, prices of the MAR-22 contract moved upwards on both sides of the Atlantic, increasing by 6% from US$2,181 to US$2,304 per tonne and by 8% from US$2,342 to US$2,530 per tonne in London and New York respectively.

At this junction, it remains undetermined whether the observed low arrivals are caused by a poor crop – despite the conducive growing conditions – or other reasons.

ICCO Report: Summary of prices movements during 2021

At the end of 2021, the annual average price of the nearby contract in London had tumbled by 5% compared to the previous calendar year as seen in Table 1. During the same period in New York, the average of the first position contract prices weakened by 1% year-on-year.

Furthermore, the annual average of the US-denominated ICCO daily price stood at US$2,427 per tonne, up by 3% compared to level reached the previous year. On the contrary, the average of the Euro-denominated prices slightly dropped by 1% year-over-year, attaining €2,054 per tonne in 2021.