ABIDJAN, Côte d’Ivoire – Flash floods have been reported in West and Central Africa¹, says the International Cocoa Organization (ICCO) in its latest report. In Côte d’Ivoire, the floods are reported to have restricted the transportation of cocoa beans from the farms to the ports² and could be the reason for the year-on-year cocoa arrivals seen during the first few weeks of the 2022/23 season at the country’s ports of exports.

Indeed, as at 06 November 2022, cumulative volumes of arrivals of cocoa beans in Côte d’Ivoire were reported at 348,000 tonnes, down by 23% year-on-year compared to 452,000 tonnes recorded during the corresponding period of the previous season.

Nevertheless, a reduction in cocoa yields is expected should torrential rainfall persist, as soil nutrients will be washed away. And, this will further exacerbate the current problem associated with increasing fertilizer prices.

In neighbouring Ghana, while no fresh data were available on the level of volumes of graded and sealed cocoa beans for the 2022/23 season, the situation is being closely monitored as the country recorded a drastic cut in production compared to last season, due in part to the devastating effect of the Cocoa Swollen Shoot Virus Disease (CSSVD), illegal mining on cocoa farms and reduced use of fertilizer due to the high prices.

Uncertain demand

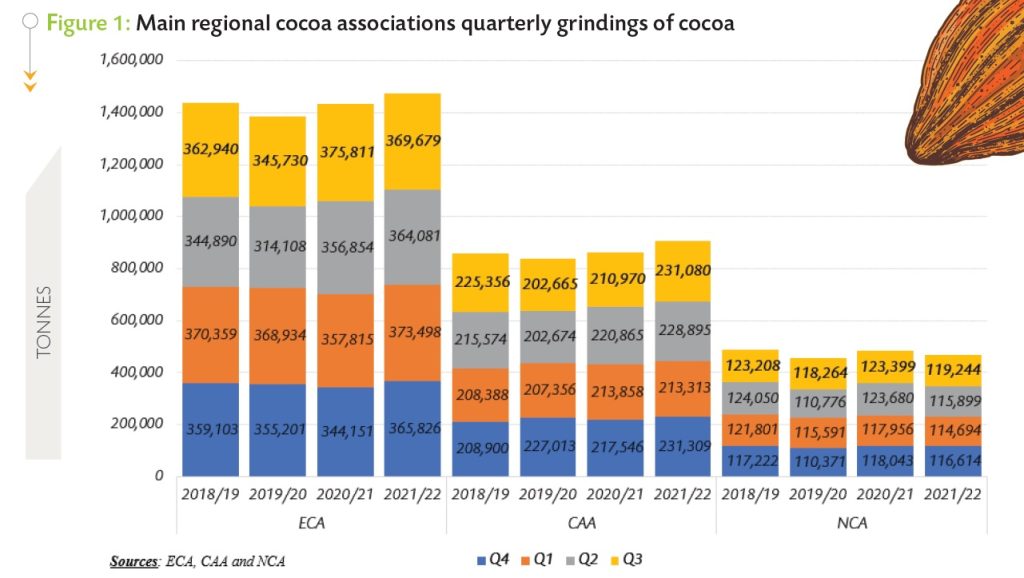

Following the recovery in grindings in 2021/22 on the back of the economic recovery from the COVID 19 pandemic, mixed results have been posted by members of the European Cocoa Association (ECA), Cocoa Association of Asia (CAA) and National Confectionery Association (NCA) – who held about 56% of the world share of grindings in 2021/22.

As presented in Figure 1, for the 2021/22 cocoa season, cocoa processing activities increased year-on-year in Europe and Southeast Asia, whereas they dropped in North America.

On a crop year basis, the ECA posted data indicating that cumulative grindings in Europe during 2021/22 increased year-on-year by 2.68% from 1,434,631 tonnes to 1,473,084 tonnes, while the CAA published data showing a 4.79% increase from 863,239 tonnes to 904,597 tonnes.

However, total grindings in North America witnessed a year-on-year decline of 3.44% from 483,078 tonnes to 466,451 tonnes according to the total quarterly statistics published by the NCA.

More recently, the above-mentioned three regional cocoa associations released reports on volumes of cocoa processed during the third quarter of the 2022 crop year. On a year-on-year basis, in Europe, grindings declined by 1.53% to 369,679 tonnes during this quarter.

Similarly to Europe during Q3.2022, cocoa transformation activities in North America contracted by 3.37% to 119,244 tonnes. However, cocoa processors in South-East Asia were reported to have increased the quantity of cocoa ground by 9.53% from 210,970 tonnes in Q3.2021 to 231,080 tonnes during Q3.2022.

The latest mixed grindings data suggest that cocoa demand at the start of the 2022/23 season remains uncertain due to the current global macroeconomic narrative on high inflation, interest rates, slow growth and concerns about energy price increases.

Development of cocoa prices in October 2022

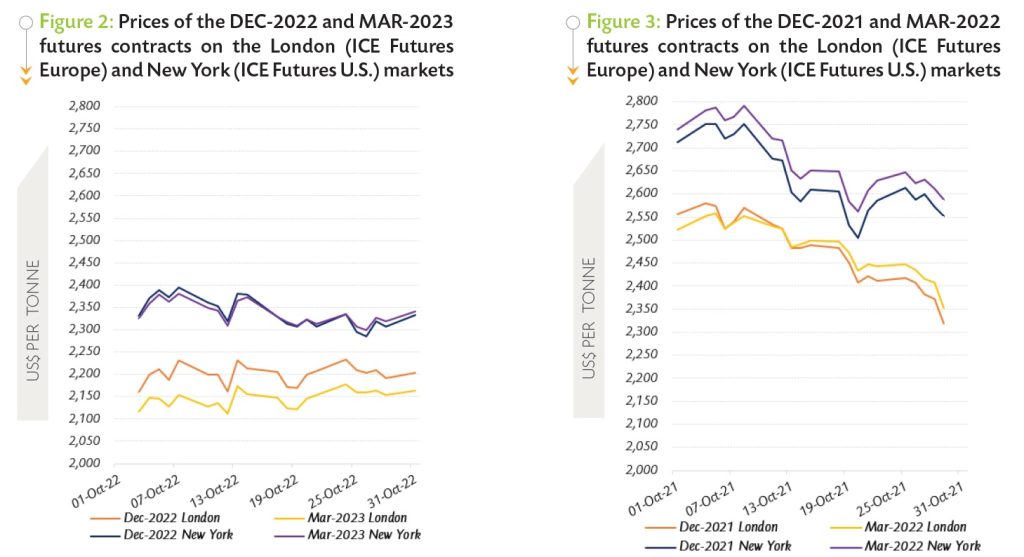

As presented in Figure 2, during the first month of the 2022/23 cocoa season, prices of the front-month contract i.e., December 2022 (DEC-22) went slightly up in London by 2% moving from US$2,159 at the beginning of the month to US$2,203 per tonne at the end of the month. For the New York market, prices of the nearby cocoa contract were virtually flat from US$2,331 per tonne at the beginning of October to US$2,333 per tonne at the end of the month.

Compared to the previous season (Figure 3), prices of the front-month contract were lower in October 2022 on both sides of the Atlantic.

In London, prices of the first position cocoa contract settled at an average of US$2,200 per tonne, down by 11% year-on-year from US$2,473 per tonne, while in New York, the average price of the nearby cocoa contract was seen at US$2,338 per tonne, equally down by 11% from the average of US$2,633 per tonne recorded back in October 2021.

The low cocoa prices could be attributed in part to the large quantities of cocoa beans harvested in the upcountry areas of Côte d’Ivoire.

Nevertheless, at the time of writing, heavy rains observed in the main cocoa growing areas in West Africa were raising concerns over a potential outbreak of the black pod disease, which could subsequently be detrimental to the volume of the 2022/23 cocoa year main crop and consequently support prices.

¹ https://www.aljazeera.com/news/2022/11/9/torrential-floods-in-west-africa-impact-food-security

² https://www.theglobeandmail.com/investing/markets/commodities/RMH19/pressreleases/11030542/cocoa-prices-retreat-on-demand-concerns/