ABIDJAN, Côte d’Ivoire – This review of the cocoa market situation reports on cocoa price movements on the international markets during the month of November 2017. It aims to highlight key insights on expected market developments and the effect of the United States dollar exchange rates on cocoa prices.

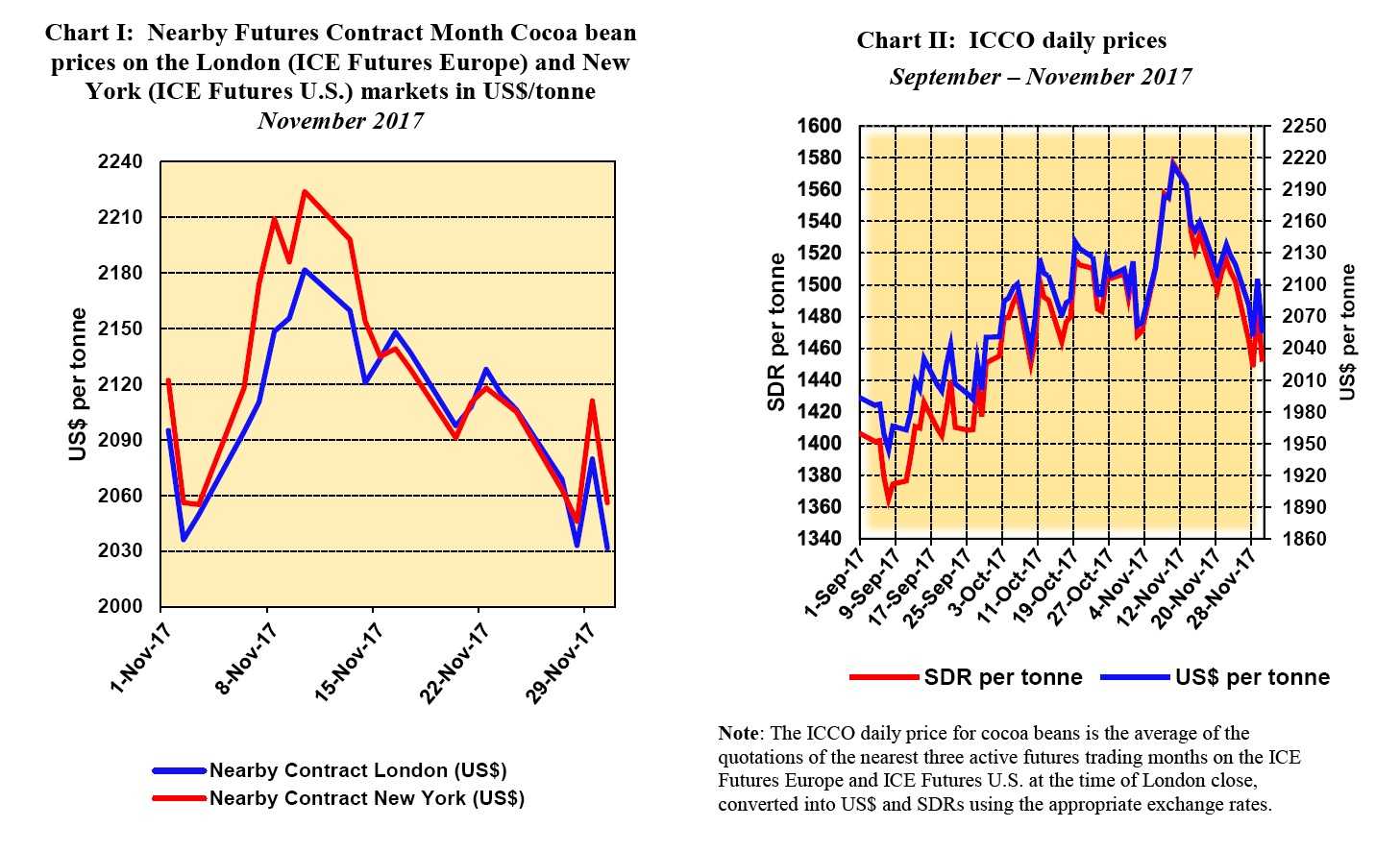

Chart I shows variations in the London and New York prices of the nearby cocoa futures contract, both expressed in United States dollars. Since the London market is pricing at par African origins, and the New York market at par Southeast Asian origins, the London futures price is expected under the same market conditions to be higher than the New York one.

Their price differences provide insights on the relative, expected availability of cocoa beans at these exchanges. Chart II distinguishes the impact of the United States dollar fluctuations on cocoa prices.

Price movements

In November, the cocoa futures market witnessed two nearby contract months i.e. the December 2017 and March 2018 contract. The December contract expired in the middle of the month under review.

As illustrated in Chart I, during the first two weeks of the month, the December contract prices remained volatile and showed an upward trend on both markets. From the start to the middle of the month, prices ranged between US$2,095 to US$2,182 per tonne in London and between US$2,122 to US$2,224 per tonne in New York.

The annualized volatility in contract prices over this same period reached 11% for London and 14% for New York. The upbeat trend in the December contract prices was still supported by unfavorable weather conditions at the beginning of the main crop season in West African origin countries. The excess rainfall is reported to have spread diseases, including brown rot and black pod disease, which could negatively affect the crop.

In mid-November, during the shift from the December contract to the March contract, whereas cocoa prices in London moved up from US$2,121 to US$2,134, that in New York moved down from US$2,154 to US$2,135. While some market participants were of the view that rains in top grower Côte d’Ivoire could lead to a negative impact for the main crop, others were of the view that this could also improve prospects for the mid-crop later in the season.

Nevertheless, the March contract traded on a negative note showing a steadily decreasing trend on both markets during the last two weeks of the month. The nearby contract prices decreased from US$2,134 to US$2,032 per tonne in London and from US$2,135 to US$2,056 per tonne in New York with an annualized volatility in contract prices reaching 9% for London and 10% for New York.

The drop in the nearby contract prices was strengthened by reports of positive expectations on the 2017/18 crop output resulting from the expectation of a mild Harmattan (dry season) in the main cocoa producing areas in Côte d’Ivoire. The dry season usually lasts from mid-November up to March, with rains relatively scarce.

London futures prices are expected to be higher than that of New York under the same market conditions. But, as observed in Chart I, since the start of the month, the nearby contract prices in New York have generally been higher than that of the London futures prices. The continuous decline in the volume of certified beans in the ICE US warehouses during the month under review is the reason for this situation.

According to the Intercontinental Exchange (ICE) daily reports on stocks of certified cocoa beans, the stocks level of cocoa beans in the United States during the month of November fell by 9% from 255,911 tonnes at the beginning of the month to 234,007 tonnes at the end of the same month.

The Ecuadorian itch grass issue weighted negatively on the level of cocoa beans stocks in the United States. Indeed, news agencies reports that ICE certified sotcks of cocoa beans from Ecuador, the world fourth largest cocoa producer, fell to 26,686 bags by during November, down 89% from the last year and down 44% from the two previous months. Over the same time frame, based on ICE reports, stocks of cocoa beans slightly increased by 0.2% from 262,630 tonnes to 263,040 tonnes in Europe.

As shown in Chart II, the US dollar-denominated ICCO prices generally moved closely with the SDR-denominated price from September to November 2017 despite the US dollar trimming in value of about 2% as against the main currencies that make up the SDR basket of currencies.

Supply & demand situation

As at 19 December 2017, total cocoa beans arrivals at ports in Côte d’Ivoire had reached around 662,000 tonnes since the start of the cocoa season, down nearly by 13% from the 750,000 tonnes produced in the same period of the previous season.

As at the time of writing, there were no official news on cocoa purchases from the Ghana Cocoa Board since the start of the season.

On the demand side, revised estimates published by the ICCO Secretariat in its latest issue of the Quarterly Bulletin of Cocoa Statistics show an increase in world grindings of 5.4% during the last crop season. Grindings reached record 4.351 million tonnes, up by 224,000 tonnes.

This higher estimate reflects the surge in grindings activities, especially in producing countries such as Côte d’Ivoire and Indonesia.

Processing activity increased by 2% to 1.622 million tonnes in Europe and less than 2% to 872,000 tonnes in the Americas whereas Africa’s increase is settled at 12%. Grindings in Asia and Oceania are estimated to have climbed by around 14%, up by 99,7000 tonnes.