This review of the cocoa market situation reports on cocoa price movements on international markets during the month of May 2018. It aims to highlight key insights on market developments and the effect of the United States dollar exchange rates on cocoa prices.

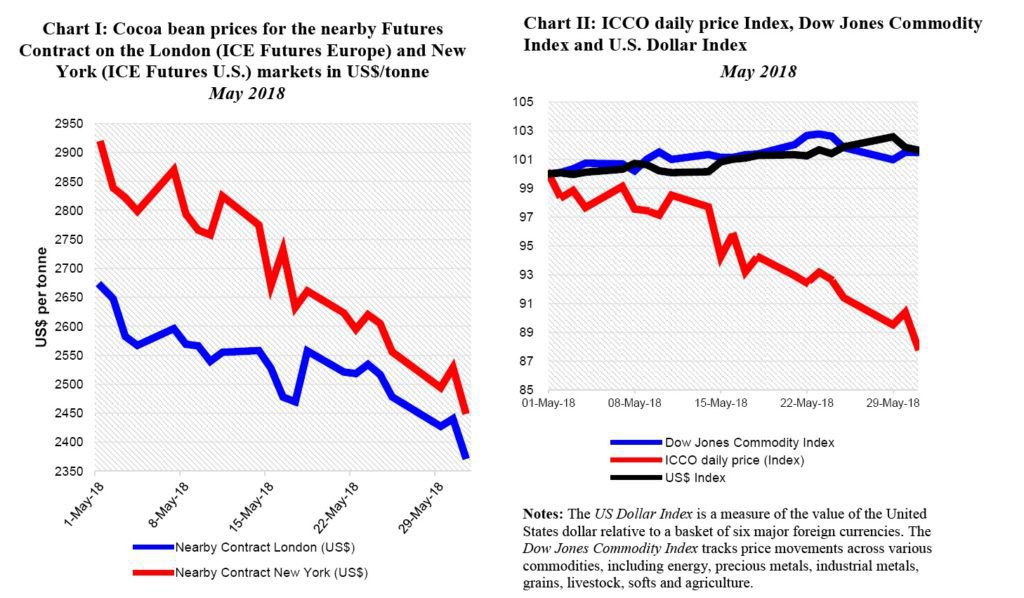

Chart I shows price developments of the nearby cocoa futures contracts on ICE U.S. (New York) and ICE Europe (London) at the London closing time. Both prices are expressed in US dollars.

The London market is pricing at par African origins, whereas the New York market prices at par Southeast Asian origins.

Thus, the London futures price is expected, under the same market conditions, to be higher than that of New York. As a result, the relative price difference provides insights into the expected availability of cocoa beans on these exchanges at the expiry of the futures contracts.

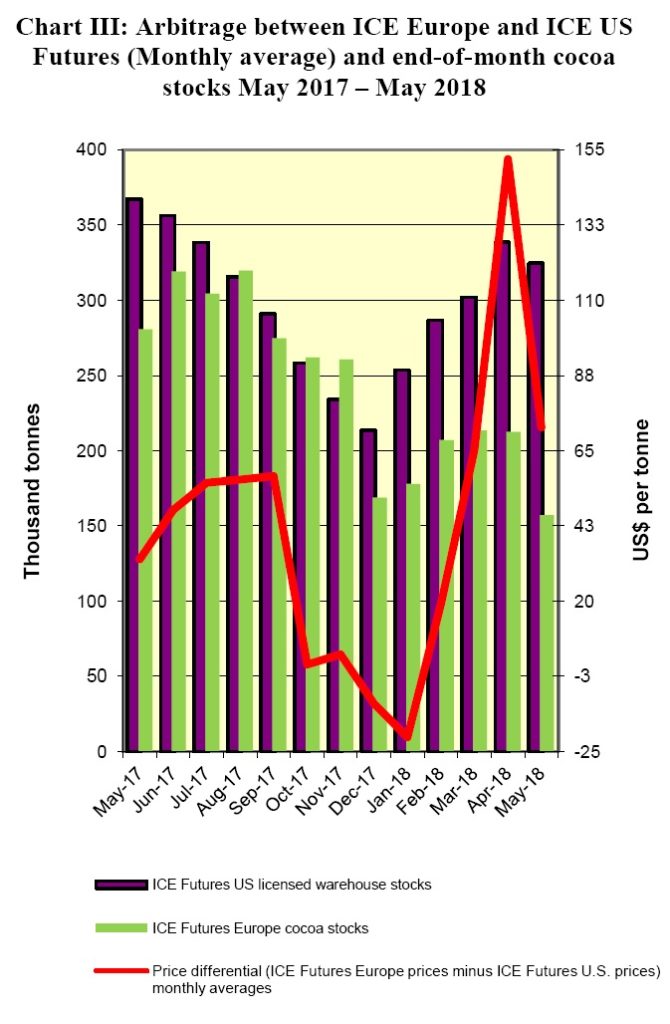

Chart II depicts the change in the ICCO daily price Index, the Dow Jones Commodity Index and the US Dollar Index in May.

Finally, Chart III illustrates the end-of-month cocoa bean stocks in licensed warehouses in Europe and in the United States and the arbitrage between ICE Futures Europe and ICE Futures U.S.

Price movements

The nearby futures contract prices witnessed a sharp downward trend during the month under review. Indeed, news that the mid-crop output is looking better than the earlier expectations of markets participants coupled with a gain in value of the US dollar pressured cocoa prices in May. Cocoa prices decreased on average by 11% in London and 16% in New York.

During the first trading day of the month, cocoa futures prices for the nearby contract closed at US$2,669/tonne and US$2,914/tonne in London and New York respectively (Chart I). They weakened further and stood at US$2,528 /tonne in London and US$2,670 /tonne in New York by the middle of May.

Over this period, cocoa futures drifted downwards as news that the second largest cocoa producer’s cumulative purchases since the beginning of the 2017/18 season had surpassed 700,000 tonnes.

This reverted market’s expectations in relation to the 2017/18 crop output.

The bearish stance continued and by the end of May, the reduction in cocoa prices, with respect to their values observed by the middle of the month, was of US$151/tonne in London to US$2,377/tonne and US$ 215/tonne in New York to US$2,455.

The supply squeeze anticipated during the previous month seemed to be fading following reports of positive prospects for the Ivorian mid-crop development.

Moreover, as depicted in Chart II, the US dollar index followed an upward trend during the period under review and weighed on cocoa prices.

While the US dollar index gained 2% with respect to its values at the start of the month, on the other hand, the ICCO daily price index retreated by 12% compared to its value at the beginning of the month.

Thus, out of 12% decline in cocoa prices, 10% is due to market fundamentals and 2% to the appreciation of the US dollar.

The phenomenon where cocoa futures prices in New York were higher than that in London during the previous month continued in May.

As showed on Chart III, the stock of cocoa beans in certified warehouses decreased from 338,000 tonnes to 325,000 tonnes in the United States and from 212,000 tonnes to 157,000 tonnes in Europe. Additionally, the spread in the end-of-month price between April and May for both markets was seen at US$72 /tonne, down from US$152 /tonne recorded by the end of the previous month.

Supply and demand situation

In its latest release of the Quarterly Bulletin of Cocoa Statistics, the ICCO Secretariat published that world cocoa production for the current season is expected to decrease by 3.3% to 4.587 million tonnes, as compared with the previous season’s estimate of 4.744 million tonnes.

Regarding demand, a 3% growth to 4.531 million tonnes is anticipated for the current season.

News agency reports indicate that, cumulative port arrivals in Côte d’Ivoire since the start of the cocoa season were seen at 1.748 million tonnes by 12 June 2018, down from 1.774 million tonnes recorded the same period last season.