ABIDJAN, Côte d’Ivoire – This review of the cocoa market situation from the Icco reports on the prices of the nearby futures contracts listed on ICE Europe (London) and U.S. (New York) during the month of May 2019. It aims to highlight key insights on expected market developments and the effect of the exchange rates on the US-denominated prices.

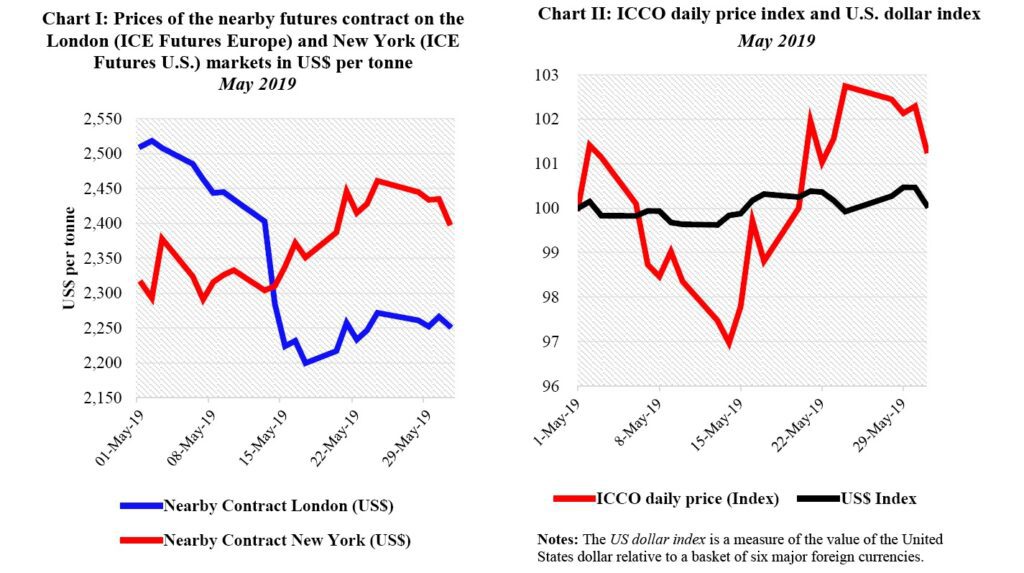

Chart I shows the development of the futures prices on the London and New York markets at the London closing time. Both prices are expressed in US dollars. African origins are priced at par with the London market, whereas they receive a premium over the New York price.

Any departure from this expected price configuration is due to the differences in the size, composition and quality of tenderable cocoa stocks in London and New York as well as their certifications rules. Chart II depicts the change in the ICCO daily price index and the US dollar index in May.

By comparing these two developments, one can disentangle the impact of the US dollar exchange rate on the development of the US dollar-denominated ICCO daily price index. Finally, Chart III illustrates monthly averages of cocoa butter and powder prices in Europe and the United States since the beginning of the 2018/19 cocoa year.

Price movements for the month in review

In May, the nearby cocoa contract prices collapsed considerably in London while they firmed in New York. Indeed, prices plummeted by 10% moving from US$2,511 to US$2,253 per tonne in London whilst in New York they strengthened by 4% from US$2,314 to US$2,401 per tonne.

On the one hand, anticipation of a lack of immediately available good-quality cocoa to be delivered in Europe against the May cocoa futures contract weighed on London prices. On the other hand, below-average rainfall recorded in Côte d’Ivoire’s cocoa producing areas contributed to vivify futures prices over the last trading days of May.

Futures prices in New York followed three main sequences. During the first two trading weeks of the month under analysis, nearby cocoa futures contract prices virtually stagnated moving from US$2,314 per tonne to US$2,310 per tonne with the exception of an isolated spike on 3 May 2019.

Afterwards, prices for the New York front month (Jul-19) contract reached their highest level of the month settling at US$2,461 per tonne. This upward trend was an implication of the outbreak of Cocoa Swollen Shoot Virus Disease (CSSVD) in Ghana’s cocoa growing areas combined with the inappropriate meteorological conditions that reigned in Côte d’Ivoire’s cocoa belt.

Nevertheless, prices in New York halted their ascent during the last five trading sessions of May dropping by 2% to US$2,401 per tonne on ideas that the market is bracing itself for a supply surplus. In addition, the rise in stocks of cocoa beans in ICE US certified warehouses may have also contributed to the fall in prices. Thus, as compared to the level seen at start of the month, stocks of cocoa beans in the ICE US certified warehouses increased by 5% from 287,626 tonnes to 300,801 tonnes at the end of May.

However, price developments in London displayed a completely different picture. Indeed, over the period 1-17 May 2019, nearby cocoa contract prices declined sharply by 12% to US$2,200 per tonne. At the same time, the volume of stocks of cocoa beans held in the ICE Europe certified warehouses increased by 10% from 120,610 tonnes to 132,420 tonnes.

As the May-19 contract approached its maturity date, i.e. 15 May 2019, the market tension stemming from the ascending share of low-quality cocoa in the ICE Futures Europe certified warehouses eased. At the expiry of the May contract, the front-month contract rolled over to July and the London market reverted to contango. Thereafter, London prices reverted slightly from their dip in the course of the last trading week of the month gaining 2% to US$2,253 per tonne.

The US dollar index was flat during the month under review and subsequently had no impact on the increase observed in the US-denominated cocoa price (Chart II).

As seen in Chart III, since the start of the 2018/19 crop year, cocoa butter and powder traded higher in the United States compared to Europe. Butter prices increased by 6% from US$5,792 to US$6,118 per tonne in the United States while in Europe these prices weakened by 2%, moving from US$5,929 to US$5,788 per tonne.

On the other hand, compared to the levels reached at the start of the crop year, cocoa powder prices crashed by 17% from US$2,353 to US$1,963 per tonne in the United States. At the same time in Europe, powder prices sank by 3% from US$1,826 to US$1,777 per tonne.

Additionally, since the 2018/19 cocoa year commenced, the monthly average for the nearby cocoa futures contract prices increased in both London and New York. Thus, futures contract prices increased by 12% from US$2,092 to US$2,337 in London, while in New York they expanded by 11% moving from US$2,140 to US$2,368 per tonne.

Cocoa supply and demand situation

In its latest issue of the Quarterly Bulletin of Cocoa Statistics, the ICCO Secretariat published that world cocoa production for the current season is expected to increase by 3.9% to 4.834 million tonnes, as compared with the previous season’s estimate of 4.652 million tonnes. Regarding the demand, a 3.4% growth to 4.750 million tonnes is projected for the current season.

Cocoa production in Côte d’Ivoire continues to race ahead toward a new record. As at 23 June 2019, cumulative cocoa arrivals, since the start of the 2018/19 crop season, were seen at 2.076 million tonnes, up by 12% from 1.860 million tonnes reached during the same period in the previous season.

Between the start of the mid-crop on 1 April and 23 June 2019, cocoa beans at Ivorian ports totaled 437,000 tonnes, up from 367,000 tonnes recorded during the same period last year. In Ghana, the COCOBOD published data showing that Ghanaian graded and sealed cocoa for the 2018/19 crop year increased by 3% year-on-year to reach 743,935 tonnes on 16 May 2019.