This review of the cocoa market situation reports on cocoa price movements on the international markets during the month of February 2018. It aims to highlight key insights on expected market developments and the effect of the United States dollar exchange rates on cocoa prices.

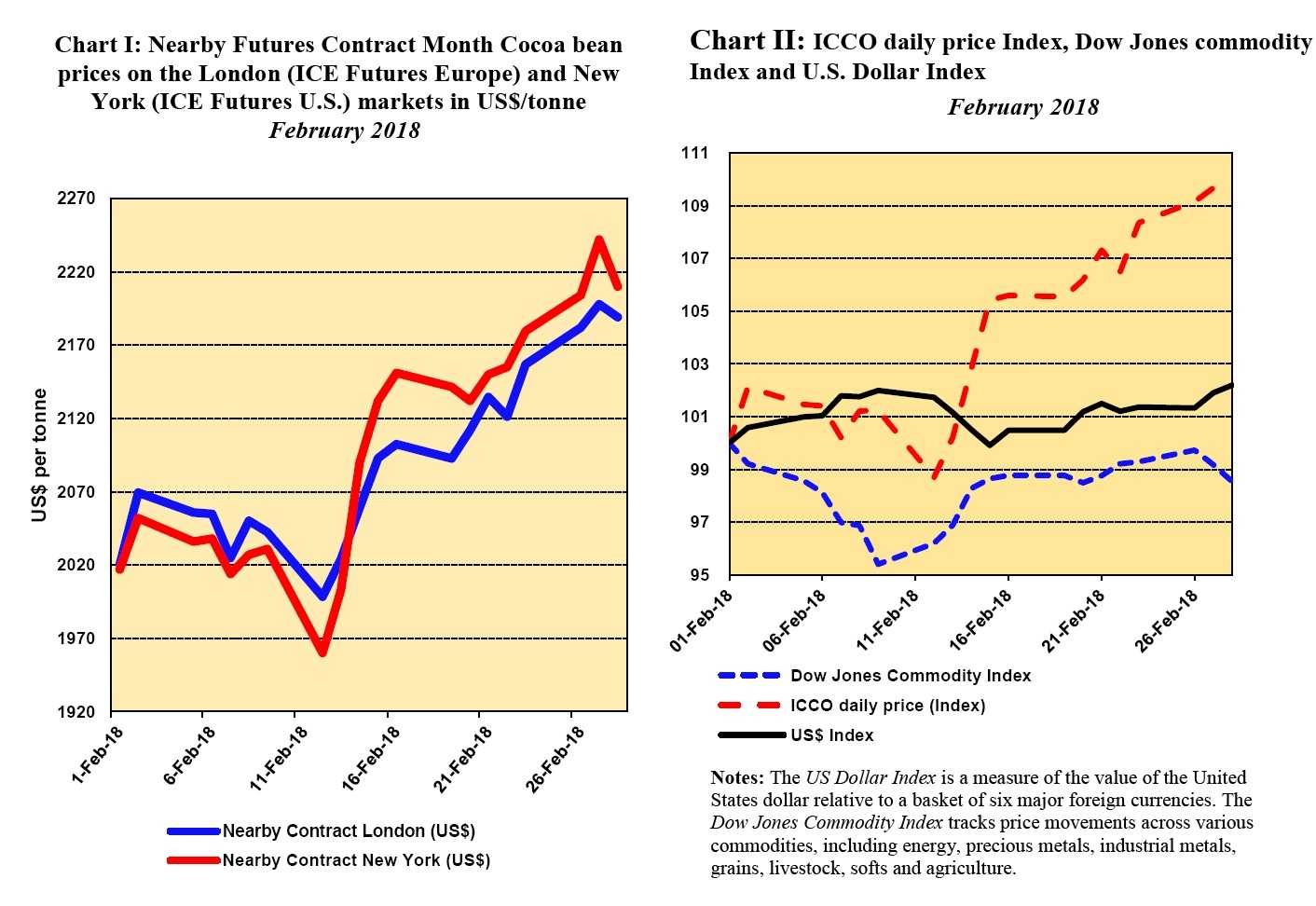

Chart I shows the historical developments in the prices of the nearby cocoa futures contracts on ICE U.S. (New York) and ICE Europe (London) at the London closing time. Both prices are expressed in US dollar.

The London market is pricing at par African origins, whereas the New York market prices at par Southeast Asian origins. Thus, the London futures price is expected, under the same market conditions, to be higher than that of New York.

As a result, the relative price difference provides insights into the relative, expected availability of cocoa beans on these exchanges at the expiry of the futures contract.

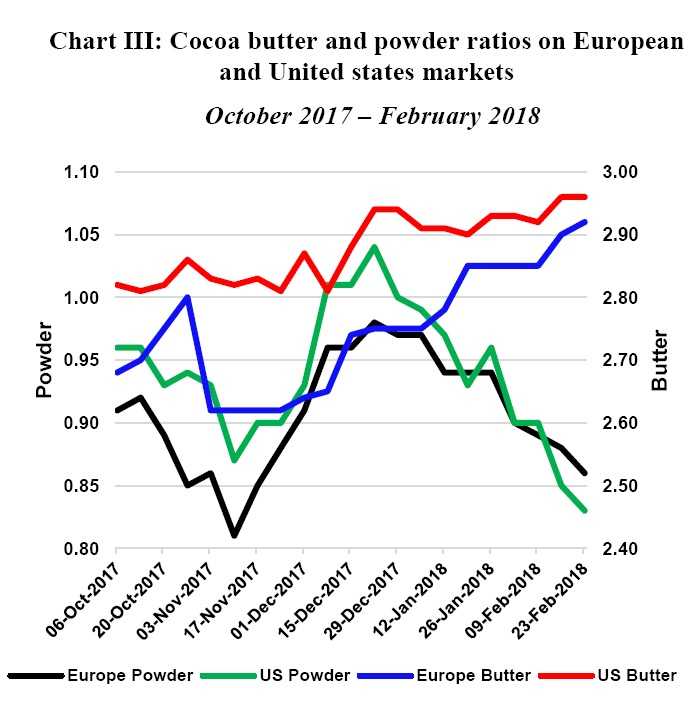

Chart II depicts the change in the ICCO daily price Index, the Dow Jones Commodity Index and the US Dollar Index in February. Finally, Chart III show cocoa butter and powder ratios since the beginning of the 2017/18 crop year.

Price movements

After an initial fall, cocoa prices rose by about 10% in both futures markets. The quality concerns on the cocoa beans sourced from the largest cocoa producing country together with the lower than expected cumulative cocoa arrivals fueled the prevailing bullish sentiment experienced in the market starting from the second half of the month.

As illustrated in Chart I during the first two weeks of February the nearby futures contract decreased by 1% and by 3% in London and New York, respectively.

This bearish stance was supported by the higher than expected volumes of cocoa arrivals in Côte d’Ivoire: 25,000 tonnes higher than the previous crop year. This news was against all market expectations elaborated until then.

Analysts had assessed that the size of the 2017/18 crop would have been slightly lower than the 2016/17 crop.

Moreover, the gain in value of the US dollar (Chart II) added another downward pressure on cocoa prices (i.e. Law of One Price). On 12 February 2018 the March contract closed at US$1,998 in London, while trading in New York at US$1,960.

Nevertheless, the news that 70% of the latest Ivorian deliveries were rejected caught all market participants by surprise. Additionally, recent industry reports from South-East Asia indicated that farmers in Indonesia were reducing the size of their cocoa plantations to grow other crops.

Finally, weather reports, emerging toward the end of the month, expressing concerns on the impact of the dry weather on the mid-crop supported the positive trend observed in futures contract prices. Such a bullish sentiment pushed cocoa prices from US$2,024 to US$2,198 in London and from US$2,003 to US$2,242 in New York (Chart I).

Supply & demand situation

The ICCO Secretariat expects the 2017/18 crop output for Côte d’Ivoire to drop slightly and settle at 2 million tonnes compared to the 2.020 million tonnes recorded last season.

At the time of writing, cumulative arrivals to Côte d’Ivoire’s main ports were reported to have reached 1.312 million tonnes by 13 March 2018 down from 1.381 million tonnes seen at the same period last season.

Should the current hot weather stand for long, the development of the mid-crop could be negatively affected.

According to the Ghana Cocoa Board, total crop output for Ghana is anticipated to settle at around 700,000 tonnes in 2017/18 down by 28% compared to the previous season output. Declared purchases as at 2 March 2018 were reported at 650,000 tonnes.

On the demand side, as published in its latest issue of the Quarterly Bulletin of Cocoa Statistics the ICCO Secretariat anticipates that world grindings of cocoa beans will rise by two per cent, to hit a level of 4.487 million tonnes as cocoa processors take advantage of low international prices resulting in high processing margins.

As shown in Chart III, since the start of the 2017/18 season (1 October), weekly reports from Commodity Risk Analysis (CRA) indicate an increase in cocoa butter ratios from 2.68 to 2.92 in Europe and from 2.82 to 2.96 in the United States.

Nevertheless, cocoa powder ratios decreased from 0.91 to 0.86 in Europe and from 0.96 to 0.83 in the United States.

The ICCO Secretariat’s first forecasts released in its latest Quarterly Bulletin of Cocoa Statistics depicts that the market is bracing itself for another surplus of around 105,000 tonnes, smaller than the previous season’s revised surplus seen at 300,000 tonnes.