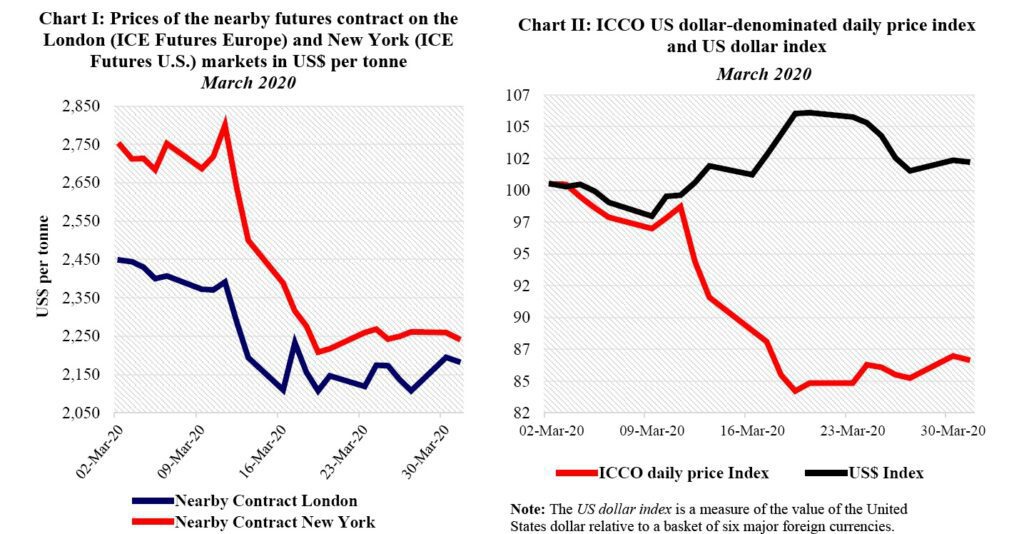

ABIDJAN, Côte d’Ivoire – This review of the cocoa market situation focuses on the prices of the nearby futures contracts listed on ICE Futures Europe (London) and ICE Futures U.S. (New York) during the month of March 2020. It aims to highlight key insights on expected developments in the cocoa market and the effect of the exchange rate on the US-denominated prices.

Chart I shows the development of the nearby futures contract prices on the London and New York markets at the London closing time. Both prices are expressed in US dollars.

Chart II depicts the change in the US dollardenominated ICCO daily price index and the US dollar index in March. By comparing these two developments, one can determine the impact of the US dollar exchange rate on the development of the US dollar-denominated ICCO daily price index.

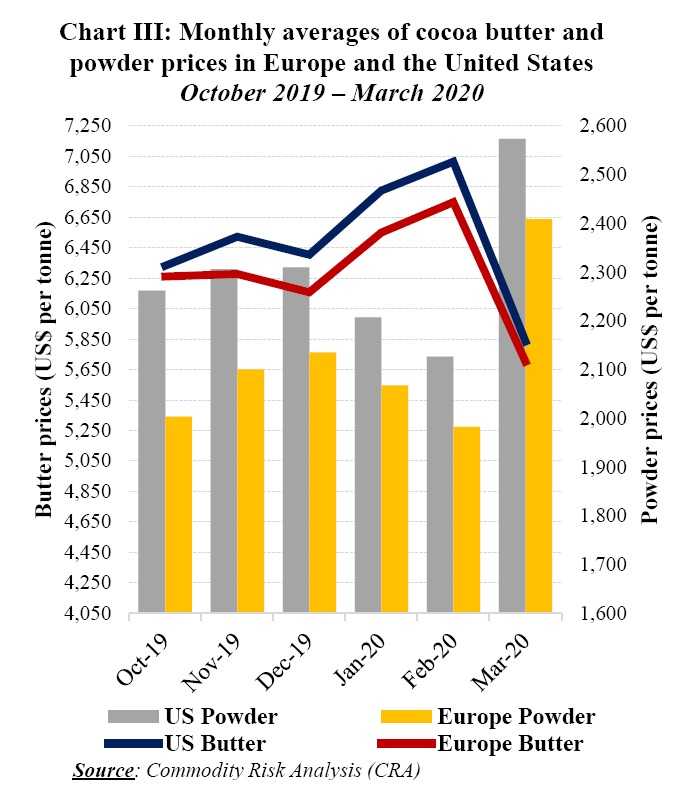

Chart III presents monthly averages of cocoa butter and powder prices in Europe and the United States since the start of the 2019/20 crop year.

Price movements

In the course of March, prices of the nearby contracts plummeted by 11% from US$2,448 to US$2,184 per tonne in London; and by 18% moving from US$2,748 to US$2,244 per tonne in New York (Chart I).

In particular, starting from 11 March, the US$-denominated prices declined abruptly as a result of an unexpected increase in the supply of Côte d’Ivoire and Ghana and the improvement of weather conditions in West Africa, on the one hand, and the rapid appreciation of the US$ against all major currencies by 5.5% during the period 11 to 24 March (Chart II).

Moreover, starting from 11 March, the differential between the New York and the London markets started to decline as the March contract – which was in backwardation only in the New York market – approached its expiration on 16 March.

The March contract was trading with a premium over deferred contracts to attract additional volumes of cocoa warrants. The backwardation of futures contracts close to expiry is now a recurrent feature of both the London and New York futures markets.

This is the direct result of the progressive withdrawal of Ivorian and Ghanaian beans from exchange-certified stocks in anticipation of the Living Income Differential (LID) which will start at the beginning of the 2020/21 season.

Chart III shows that compared to the average prices recorded at the start of the 2019/20 cocoa year, prices for cocoa butter sunk on both of the world’s largest cocoa consuming markets namely Europe and the United States during March.

Indeed, prices for cocoa butter shrunk by 8% from US$6,331 to US$5,834 per tonne in the United States, while in Europe they dropped by 9%, moving from US$6,260 to US$5,701 per tonne. Concerning cocoa powder, compared to the levels reached in October 2019, prices firmed by 14% from US$2,261 to US$2,573 per tonne in the United States.

During the same time frame in Europe, powder prices rose by 20% from US$2,003 to US$2,408 per tonne. In addition, compared to their average values recorded in October 2019, the front-month cocoa futures contract prices weakened by 7% and 0.2% in London and New York respectively at the end of March 2020.

They dived from US$2,423 to US$2,254 in London, while in New York they plunged from US$2,467 to US$2,461 per tonne.

Cocoa market: supply and demand situation

In Côte d’Ivoire, the 2019/20 mid-crop started in April with the Government’s decision to maintain the farmgate price at XOF 825 (US$1.40) per kilogram of cocoa beans; the same price as during the main crop.

As at 5 April 2020, cumulative cocoa arrivals at Ivorian ports for the 2019/20 cocoa year were estimated at 1.677 million tonnes, down by 2.8% from 1.725 million tonnes recorded over the same period last season.

In addition, the country was reported to have exported 914,680 tonnes of cocoa beans during the first five months of the 2019/20 crop year; down by 3.5% from the level reached the same period a year earlier.

As for semifinished products of cocoa, Côte d’Ivoire exports declined abruptly by 22% year-on-year to 147,431 tonnes.