LONDON, UK – The Secretariat of the International Cocoa Organization (ICCO) has decided to issue a statement in response to information made public, ahead of a scheduled meeting, which pointed to a significant upward revision of its cocoa supply deficit for the 2012/2013 season.

The ICCO Expert Working Group on Stocks (EWGS) met on Friday 24 January 2014 to review the level of world cocoa bean stocks.

The EWGS is composed of experts in the cocoa field who meet once a year, at the invitation of the ICCO, to review and analyse the results of the ICCO’s annual survey of cocoa stocks held in warehouses worldwide. The survey has been conducted every year since 2000 and aims to improve transparency in the cocoa market.

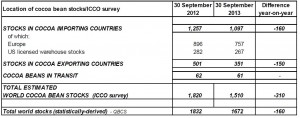

The result of the latest survey showed that world cocoa bean stocks fell to 1.510 million tonnes as at the end of the 2012/2013 cocoa year (30 September 2013), 310,000 tonnes lower than the previous year.

This result appeared to show a significantly larger supply deficit than the one published by the ICCO in November 2013 in its latest Quarterly Bulletin of Cocoa Statistics (QBCS), estimated at 160,000 tonnes for the 2012/13 season (click to enlarge).

However, the review conducted by the EWGS during its meeting led to the conclusion that the survey results had underestimated existing world stocks and that consequently the cocoa supply deficit for the 2012/13 season was lower than the 310,000 tonnes identified by the survey. It concluded that part of the difference could have been attributed inter alia, to the following: – Increase in “invisible” stocks, i.e. stocks held in locations not reporting to the ICCO survey; – Cocoa beans in transit higher than estimated. The ICCO Secretariat maintains, so far, its supply deficit estimate of 160,000 tonnes for 2012/13 as published in its latest QBCS, and to be revised only in its next Bulletin due at the end of February 2014.

The ICCO regrets that the confidentiality of the working documents sent to the EWGS ahead of the meeting was not adhered to and led to possible misinterpretation of the information by some market players, which may have had an impact on futures prices on the 23rd of January 2014 in particular.