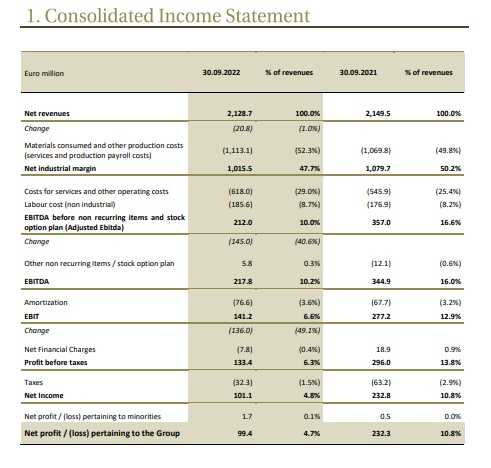

TREVISO, Italy – The Board of Directors of De’ Longhi SpA has approved the consolidated results for the first nine months of 2022. The major results can be summarized in the following key points: revenues of € 2,128.7 million, down by -1% (-5.4% at constant exchange rates); an adjusted Ebitda of € 212 million, equal to 10% of revenues (down from 16.6%); a net profit of € 99.4 million, equal to 4.7% of revenues (down from 10.8%).

De’ Longhi SpA results for the third quarter

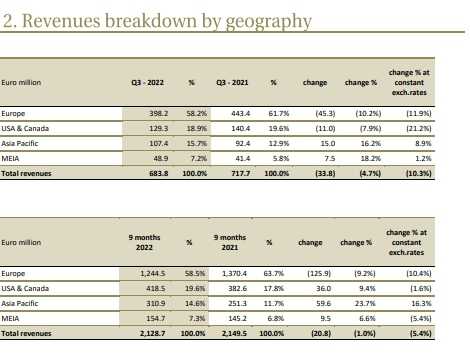

In the third quarter the Group achieved revenues of € 683.8 million, down by -4.7% (-10.3% at constant exchange rates); an adjusted Ebitda of € 62.9 million, equal to 9.2% of revenues (down from 14.7%).

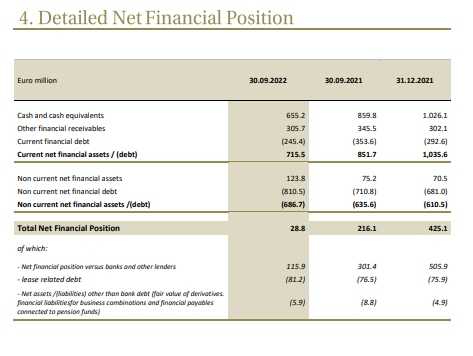

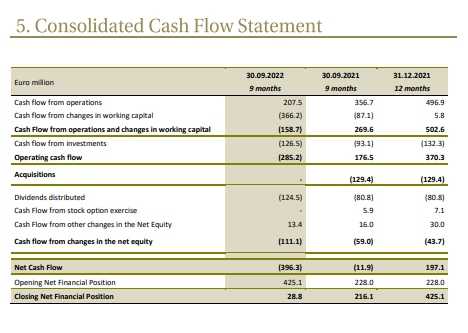

At 30 September 2022, the Group‘s net financial position was positive for € 28.8 million, down from €425.1 million at the end of 2021, after capex for € 126.5 million and dividends distributed for € 124.5 million.

Fabio de’ Longhi stated:

“The third quarter was in line with our guidance and with market expectation for the full year. In a context of great uncertainty of the macroeconomic scenario, we have seen a demand slowdown and a consequent inventory excess that we are successfully committed to gradually bring back to normal levels, thus relieving next year from the related costs and inefficiencies.”

Fabio de’ Longhi continues: “Furthermore, we have largely offset the production cost inflation with a campaign of price increases made possible by the strength of our brands and the trust granted us by the consumers.”

He adds: “Finally, from a long-term perspective, we have given continuity to the communication and marketing investments foreseen by the three-year plan and which are a solid basis for the growth in the coming years.”

Fabio de’ Longhi concludes: “The indications for our core segments remain unchanged: on one hand, the secular trend in coffee, which is confirmed year after year, with potential growth still largely unexpressed; on the other hand, a deep-rooted presence in leadership positions in the nutrition and cooking world, supported by the growing role of a sustainable and healthy diet. For the current year, we confirm our current guidance of revenues down mid-single-digit and an adjust Ebitda in the range of 320-240 millions.”

Increasing complexities

The first nine months of 2022 showed a sales trend substantially in line with the previous year, supported however by an important positive currency effect, while volumes showed a progressive slowdown, penalized by the difficult macroeconomic context.

This context, which worsened with the outbreak of the Russian-Ukrainian conflict, undermined the confidence of markets and consumers, especially in Europe and still today presents elements that are likely to persist in the coming months.

In recent quarters, companies in the sector have had to face increasing complexities, such as inflationary pressures on product costs, rising interest rates, growing expectations of an upcoming recession, the volatility of the currency markets, the increase in the level of stock at retailers and, last but not least, the challenging comparison with an extremely positive 2021.

Price increases

Such a scenario required a greater commitment from the Group to support long- term growth – by keeping high investments in media and communication – and to protect margins by introducing selective price increases.

In the first nine months of 2022, revenues decreased by -1%, reaching € 2,128.7 million, with a third quarter down by 4.7% to € 683.8 million.

In both periods analyzed, the currency effect was markedly positive, especially in relation to the appreciation of the US dollar: the positive impact on revenues was equal to a +4.4% growth in the nine months and a +5.6% % in the quarter.

Similarly to the second quarter, the European area was impacted by the major slowdown, while the remaining non-European areas benefited largely from more favorable dynamics.

In the third quarter

• South-West Europe in the third quarter showed similar dynamics to the previous quarter, with a moderate weakness of the continental Europe markets, while Italy and the Iberian region showed some growth;

• in North-Easter Europe the negative trend continued, albeit improving, with understandable effects of the Russian-Ukrainian conflict and a direct impact of the two countries involved accounting for more than half of the slowdown in the area;

• the MEIA region saw a quarter of growth throughout the Middle East, driven above all by the positive currency contribution, net of which, however, sales were still in positive territory;

• the North American area decreased compared to last year, due to early sales of portable air conditioners in the previous months, while on the contrary there was a double-digit growth in the coffee segment, supported by a strong acceleration of full-automatic machines;

• finally, in the Asia-Pacific region the double-digit growth already delivered in the first half of the year continued, sustained in particular in the quarter by the significant expansion of Greater China.

As regards the evolution of product segments, the first nine months of 2022 confirm the resilience of coffee on the one hand, but on the other a marked weakness in the food preparation, while the remaining product categories also showed growth in the quarter.

Going into detail, the sector of coffee machines for households continued to grow supported by full-automatic and manual machines.

The cooking and food preparation segment confirmed the particularly difficult period of the post-Covid as well as the impact of the weakness in consumption.

The contribution of the comfort category (portable air conditioners and heaters) remained positive, even if in the third quarter air conditioning products slowed down due to early sales in the USA and a lower sell-in in Europe.

Home care (home cleaning and ironing) was in positive territory in both periods under analysis, thanks in particular to the double-digit growth of ironing in the third quarter.

Finally, the contribution of the professional coffee machines segment, represented by the newly acquired Eversys, which showed a very sustained growth trend, was largely positive.

As to margins

• the net industrial margin in the 9 months was € 1,015.5 million, down as a percentage of revenues to 47.7% from 50.2%, as an effect of the increase in product costs (raw materials, freight, transformation costs) not fully offset by price increases (equal to € 48 million in the 9 months). Even in the third quarter, the dynamics of the margin did not show trend reversals, despite greater support provided by the price component (€ 15.6 million);

• adjusted Ebitda in the 9 months amounted to € 212 million, equal to 10% of revenues (compared to 16.6% in 2021). This margin trend was affected by the € 32.5 million increase in investments in media and communication, which went from € 238.9 million (11.1% of revenues) to € 271.4 million (12.8% of revenues), especially in connection with the activities relating to the coffee campaign starring Brad Pitt, Ambassador of the De’ Longhi brand. However, this increase was concentrated in the first two quarters, while the third quarter saw, on the contrary, a reduction of the same of € -1.7 million compared to the same quarter of 2021;

• the 9-month Ebitda amounted to € 217.8 million, equal to 10.2% of revenues (16% in 2021). It should be noted that non-recurring income (equal to € 4.4 million) was recognized in the quarter, mainly relating to the revision of the valuation of some assets of the Ukrainian branch, following the recovery of some credit positions;

• Ebit amounted to € 141.2 million, equal to 6.6% of revenues, down from 12.9% in 2021, after higher depreciation of € 8.9 million (€ 2.2 million in the quarter), resulting from the increase in investments in the last few quarters;

• finally, the net profit pertaining to the Group in the 9 months amounted to

€ 99.4 million, equal to 4.7% of revenues (10.8% of revenues in the 9 months of 2021), with a trend of decline in the third quarter substantially not dissimilar to the same quarter of 2021, although less negative in terms of comparison.

The sustained investment activity

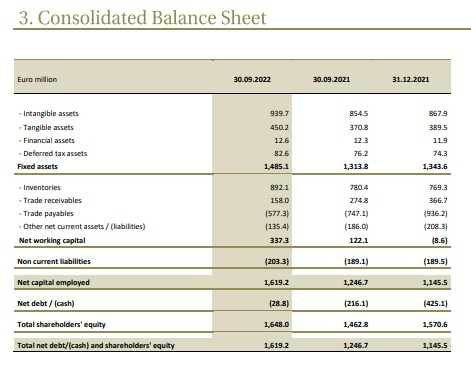

As to the balance sheet, the Group first of all highlight the sustained investment activity, largely concentrated on production plants, for a total of € 126.5 million in the first nine months of the year.

With regard to the net working capital (equal to € 337.3 million at 30 September 2022), the increase of € 215.3 million in the 12 months was mainly affected by:

An increase in inventories, whose value at the end of the quarter reached the value of € 892.1 million, i.e. € 111.7 million higher than the values at the end of September 2021, but gradually decreasing compared to the peak of € 941,5 million touched at 30 June 2022;

A reduction in the net trade receivables-payables, resulting from a slowdown in the procurement activity for production.

Due to the aforementioned trends, the ratio of operating working capital to rolling revenues went up to 14.8% from 10.2% as at 30 September 2021.

The Net Financial Position as at 30 September was positive by € 28.8 million, compared with € 425.1 million at 31.12.2021 and with € 216.1 million at 30 September last year. However, excluding non-banking components, the Net Position was positive by € 115.9 million (vs. € 505.9 million at the end of 2021).

As a result of the above, the free cash flow before dividends and acquisitions in the 9 months was negative by € 271.8 million, of which only € 26.6 million relating to the third quarter.

De’ Longhi results in detail