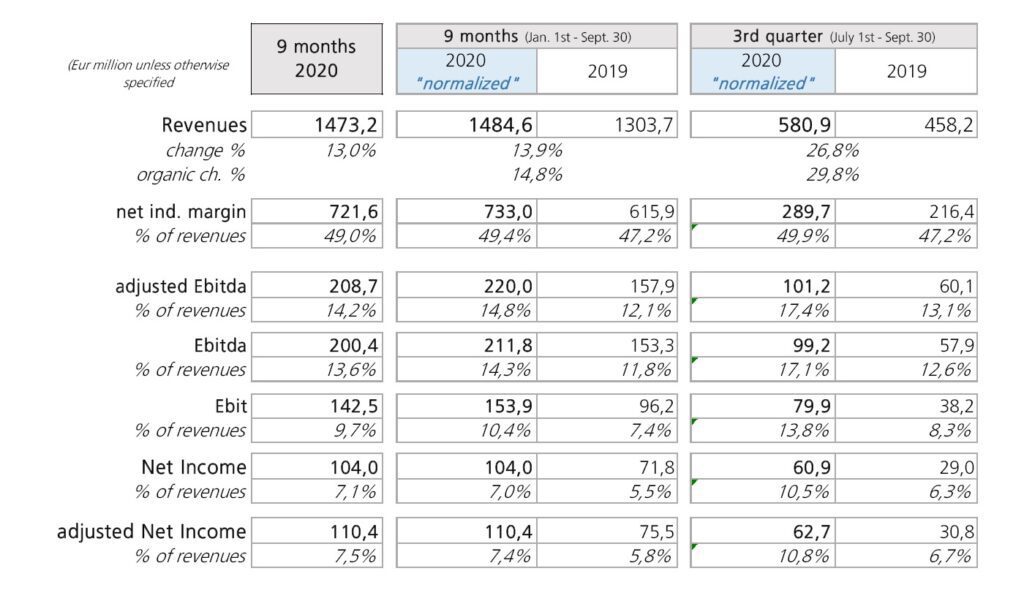

TREVISO, Italy – The Board of Directors of De′ Longhi SpA today approved the results for the nine months of 2020.¹ In the nine months the Group achieved revenues of € 1,473.2 million, up 13% (+ 13.9% at the normalized 1 level and + 14.8% at the normalized organic² level) an adjusted 3 Ebitda of € 208.7 million, equal to 14.2% of revenues (14.8% in normalized 1 terms), an improvement from 12.1% in 2019, and a net profit of € 104 million (adjusted net profit of € 110.4 million, up 46.3% compared to the previous year).

In the third quarter, the Group achieved:

- revenues of € 576.6 million, up by 25.8% (+ 26.8% at normalized 1 level and + 29.8% at organic 2 level);

- an adjusted³ Ebitda of € 96.9 million, equal to 16.8% of revenues (17.4% in normalized 1 terms), an improvement of 61.1% from 2019;

- a net profit of € 60.9 million, up 110%.

In the first 9 months of the year the company generated cash for € 173.7 million, increasing its net financial position at 30 September to € 451.5 million (from € 277.8 million at 31 December 2019). In the rolling 12 months, cash generation was € 350 million.

The CEO of De′ Longhi Massimo Garavaglia commented:“We have always been convinced of the strength of our brands and the potential of our products: beyond the contingent conditions of the market, we believe in the superiority of iconic products supported by investment campaigns that accompany their development in the medium term.

Therefore we will continue to invest in innovation, marketing and communication and the current results confirm the correctness of our strategy. Looking at the shorter term, we still recognize many elements of uncertainty, which make reading the social and economic context still very difficult. With these results behind us, we revise our end-of-year guidance upwards and we are confident that we will be able to close 2020 with organic growth in revenues at a high single digit rate and an adjusted Ebitda increasing both in value and as a percentage of revenues. In the longer term, we remain focused on the execution of our strategy, according to the value creation model that has guided us so far”.

The Board of Directors also, in light of the good performance of the Company and the De′ Longhi Group in the current year, proposed the distribution of a dividend of € 0.54 per share drawn from the extraordinary reserve also formed with 2019 profits.

Finally, as part of the strategy of extending the average effective duration of the Group’s debt portfolio and to take advantage of the good market conditions, the Board of Directors mandated the Chief Executive Officer to proceed with the preparatory activities for the issue of a second tranche of a non-convertible, unlisted and unrated bond loan for an amount equal to Euro 150 million with a duration of twenty years and maturity to 2041 which will be subscribed by leading US investors.

De′ Longhi: Results summary and business review

At the same time, however, the increased attention of consumers towards the domestic sector has driven sales of household products, in particular related to food: the segments of coffee and food preparation and cooking have shown growth rates beyond expectations, amplified by the positive effects deriving from the support offered by the strength of brands and products and a careful long-term investment strategy in marketing and communication.

At the same time, however, the increased attention of consumers towards the domestic sector has driven sales of household products, in particular related to food: the segments of coffee and food preparation and cooking have shown growth rates beyond expectations, amplified by the positive effects deriving from the support offered by the strength of brands and products and a careful long-term investment strategy in marketing and communication.

As to our organizational, the Group continued to implement all the prevention measures adopted in the previous months, in the peak phase of the pandemic, in order to protect the health of its employees and collaborators in the best possible way.

Revenues

Revenues for the 9 months, up 13% to € 1,473.2 million, were driven by the strong growth in the third quarter, in the wake of the favorable trend of the first half, which saw revenues grow by 25.8% ( + 26.8% normalized and + 29.8% organic).

The normalized currency effect was negative by € -12.2 million in the 9 months, mostly due to the exchange rate trend in the third quarter (normalized negative effect of € -13.7 million): depreciated currencies that weighed in particular were the US Dollar, the Ruble, the Australian Dollar and the Polish Zloty.

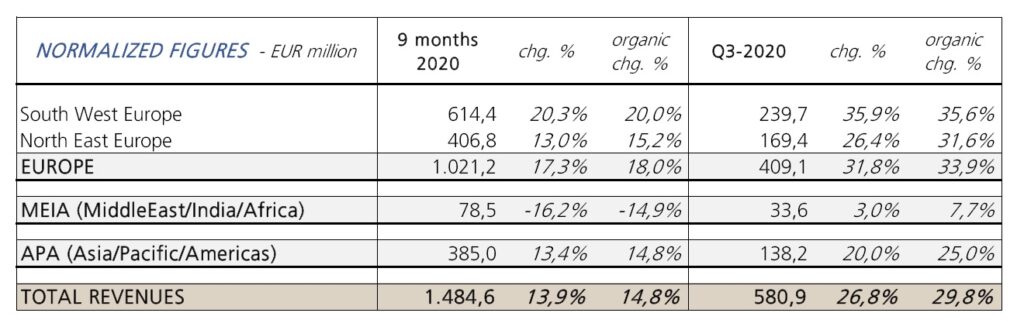

Markets

Growth at a geographical level was important in all areas and in the third quarter it also expanded to the MEIA area (Middle East-India-Africa), negative in previous quarters, which has now grown, on an organic and normalized basis, by 7.7% in the quarter.

On a normalized basis:

On a normalized basis:

- South-Western Europe grew by 20.3% in the 9 months (35.9% in the third quarter), thanks to the contribution of all countries, with Germany and France in the spotlight;

- similarly North-Eastern Europe also grew double-digit: + 13% in the 9 months and + 26.4% in the quarter: the performance of the United Kingdom, Poland, Scandinavian countries and Benelux was particularly positive;

- as anticipated above, the MEIA region as a whole recorded an organic growth of 7.7% in the quarter, thus marking a turnaround compared to the previous quarters, which were negative and still affecting the results of the 9 months (down -14.9% organic);

- in the APA region (Asia-Pacific-Americas) (+ 13.4% in 9 months and + 20% in the quarter) all the main countries grew double-digit: United States and Canada, greater China, Japan, Australia and New Zeland.

Products

At a normalized level, all product segments grew in the 9 months, with the exception of portable heating and ironing – the latter, however, in double-digit organic growth in the third quarter. In the quarter, coffee machines accelerated at a growth rate of over 30%, with double digit growth in all product families, with the full-automatic models leading.

In the cooking and food preparation segment, not only was the great moment of kitchen machines confirmed – in high double-digit growth in the quarter and in the nine months – but in the quarter all the main product families grew, including those which had not yet shown a recovery in the previous quarters.

As for the remaining segments (comfort and home care), the nine months closed with growth, with the exception, however, as anticipated, of portable heating (due to unfavorable weather conditions) and ironing (the latter experiencing a strong recovery in the third quarter).

De′ Longhi: Operating margins

Moving on to margins, in normalized terms, a generalized improvement was confirmed in the nine months:

- the net industrial margin went from 47.2% to 49.4%, thanks to savings in the cost of the product and the contribution of the price-mix component;

- adjusted EBITDA amounted to € 220 million, up 39.3%; as a percentage of revenues, there was an improvement of 2.7 percentage points on revenues, from 12.1% to 14.8%, despite an increase in investments in media and communication to 11.6% of revenues in the third quarter (+0.8 percentage points compared to the third quarter of 2019);

- Ebitda went from 11.8% to 14.3% of revenues, amounting to € 211.8 million;

- Ebit was € 153.9 million, an increase of 60%;

- finally, the net profit was € 104 million, equal to 7% of revenues.

In the third quarter, the increase in margins was even more marked, equal to +33.8% for the net industrial margin (€ 289.7 million), + 68.3% for the adjusted Ebitda (€ 101.2 million) and + 110% for net income (€ 60.9 million).

De′ Longhi: The balance sheet

The aforementioned income development was at the origin of a particularly strong cash generation, equal to € 350 million in the 12 months, from September ’19 to September 2020, and to € 173.7 million in the first nine months of this year, despite a significant and slightly increasing capital investment flow (€ 58.7 million against € 55.5 million in the nine months of 2019).

Net working capital decreased by € 96.7 million from the beginning of the year, mainly due to the trend of collections from customers and the increase in payables to suppliers. In relation to rolling revenues, net working capital decreased to 9.8% from 15.2% at the end of 2019 and from 18.6% at the end of September 2019.

The dynamics described led to a marked strengthening of the net financial position which stood at € 451.5 million at 30 September, with a positive net position towards banks and lenders of € 516.7 million.

We recall that in the current year, in consideration of the growing difficulties of the country and the territory in the face of the spread of the pandemic, the Shareholders’ Meeting resolved not to distribute dividends (which had been distributed for € 55.3 million in the previous year) and at the same time the Group provided financial support of € 3.1 million in favor of the local sanitary structures involved in the fight against the outbreak.

We recall that in the current year, in consideration of the growing difficulties of the country and the territory in the face of the spread of the pandemic, the Shareholders’ Meeting resolved not to distribute dividends (which had been distributed for € 55.3 million in the previous year) and at the same time the Group provided financial support of € 3.1 million in favor of the local sanitary structures involved in the fight against the outbreak.

Finally, in the nine months, the Company completed a buy-back of treasury shares for a total of € 14.5 million, in relation to the existing stock option plan.

1 ) The 2020 and 2019 figures are prepared in line with the application of the accounting standard IFRS 16. Furthermore, for comparative purposes, we may present so called “normalized” values, that is, comparable with those of the previous year, excluding the effects deriving from the reclassification of financial discounts (previously classified among financial charges and now included among commercial premiums and therefore netting the revenues).

2 ) “organic” stands for at constant exchange rates and excluding the derivative effect.

3 ) “adjusted” stands for gross of non-recurring expenses / income and of the notional cost of the stock option plan.