ABIDJAN, Côte d’Ivoire – In April, cocoa grindings data published by the main regional cocoa associations for the second quarter of the 2022/23 season indicated an overall increase in major cocoa-consuming markets. In fact, with the exception of North America where a year-on-year reduction in grindings was observed during Q1.2023, grindings in Europe and South-East Asia witnessed increments.

Meanwhile, cocoa processing was also reported to have improved year-on-year in Côte d’Ivoire while on the contrary in Ghana, it was reduced during Q4.2022.

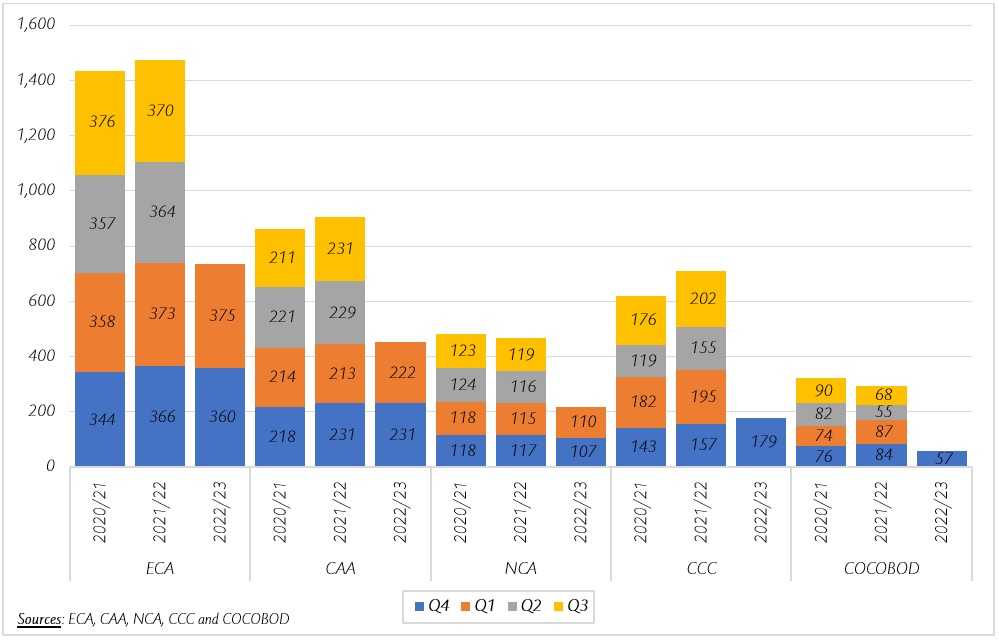

Figure 1 contains the quarterly grindings of three cocoa associations – the European Cocoa Association (ECA), the National Confectioners’ Association (NCA), and the Cocoa Association of Asia (CAA) – and two para-statal agencies regulating the cocoa sector in Côte d’Ivoire – Conseil du Café et du Cacao (CCC) – and in Ghana – Ghana Cocoa Board (COCOBOD).

It should be noted that, based on the latest available official statistics at the time of writing, grindings data for the CCC and COCOBOD cover only the first quarter (Q4.2022) of the 2022/23 cocoa year and it is very likely this trend might be reversed for Ghana in subsequent quarters.

The combined grindings data over Q1.2023 for ECA, CAA, and NCA indicate that cocoa processing in these three regions amounted to 707,069 tonnes, up by 1% year-on-year. Diving into the details, the ECA posted that, grindings slightly increased in Europe by 0.5% year-on-year to reach 375,375 tonnes during Q1.2023 compared with 373,498 tonnes recorded a year earlier.

The NCA reported a year-on-year decline of 4.38% in cocoa processing amounting to 109,666 tonnes against 114,694 tonnes recorded during the first quarter of 2023. In Southeast Asia, the CAA posted data showing that cocoa processing activities in the region were revamped year-on-year during Q1.2023, increasing by 4.09% from 213,313 tonnes in Q1.2022 to 222,028 tonnes in Q1.2023.

In Brazil, according to the National Association of the Cocoa Processing Industry (AIPC), the local processing of cocoa beans increased by 15.47% from 55,439 tonnes in Q1.2022 to 64,013 tonnes in Q1.2023. The increase in Brazilian cocoa grindings was accompanied by an increase in the imports of cocoa beans of the country, almost doubling from 15,515 tonnes to 34,923 tonnes.

Cumulative regional cocoa grindings during Q4.2022-Q1.2023 diminished year-on-year Notwithstanding the positive stance seen in regional cocoa processing activities during Q1.2023, a completely different picture emerges, when comparing regional grindings data on a semi-annual basis.

The sum of semi-annual grindings data of ECA, CAA, and NCA over the first half of 2022/23 reached 1,404,582 tonnes, down by 1% (or 10,672 tonnes less) compared to 1,415,254 tonnes of cocoa processed at the corresponding period of the 2021/22 cocoa year. It is worth noting that over the 2020/21 and 2021/22 cocoa years, the volumes of cocoa processed by members of ECA, CAA, and NCA represented together a stable share of 56% of the global grindings.

Comparison of cocoa grindings and trade data during Q4.2022 – Q1.2023

The grindings data during the first half of 2022/23 for ECA indicate that cocoa processing in Europe amounted to 734,952 tonnes, slightly up by 0.59% year-on-year. Over the first six months of 2022/23, net imports of cocoa semi-finished products from the European Union amounted to 33,644 tonnes¹, down from 100,952 tonnes seen during the corresponding period of the previous season.

Moreover, net imports of cocoa beans into the European Union over Q4.2022-Q1.2023 increased by 22% year-on-year to 641,539 tonnes. The NCA reported a year-on-year decline of 6.27% in cocoa processing amounting to 216,796 tonnes against 231,308 tonnes recorded during the first semester of 2021/22.

Also, accounting for trade data on cocoa semi-finished products for both Canada and the United States, it emerged that during the first half of the 2022/23 cocoa year, both countries imported 317,651 tonnes² of cocoa semi-finished products, up by 17% compared to 270,753 tonnes of cocoa semi-finished products imported during the corresponding period of the 2021/22 season.

Over the same period, net imports of cocoa beans into the United States and Canada taken together reached 241,109 tonnes, up by 15.60% year-on-year.

The increase in net imports of cocoa beans into North America is reflected in the currently high level of stocks of cocoa beans in Exchange monitored warehouses in the region. The reduction in domestic processing of cocoa beans in North America combined with the rise in the imports of cocoa semi-finished products suggest that the excess in North American domestic cocoa demand is satisfied by cocoa semi-finished products sourced from other regions of the world, and more so because both countries are net importers of cocoa semi-finished products.

In Southeast Asia, the CAA posted data showing that cocoa processing activities in the region were revamped year-on-year during Q1.2023, increasing by 4.09% from 213,313 tonnes in Q1.2022 to 222,028 tonnes in Q1.2023.

Supply of cocoa beans for 2022/23 currently lags behind 2021/22

At the time of drafting this report, available information on crop sizes in main cocoa-origin countries in West Africa suggests that compared to the 2021/22 cocoa year, the 2022/23 cocoa season is heading towards a supply deficit due to a reduction in production. Indeed, as at the end of April 2023, arrivals at Côte d’Ivoire ports of exports were reported to lag behind volumes recorded during the corresponding period of the previous season.

By 7 May 2023, cumulative arrivals of cocoa beans in the country were seen at 1.945 million tonnes, down by 7.04% (-137,000 tonnes) compared to 2.082 million tonnes seen over the same period of the previous cocoa year. In addition, the country’s exports of cocoa beans from October 2022 to March 2023 were reported at 1,005,510 tonnes, slightly down by 0.5% compared to 1,010,080 tonnes exported from October 2021 to March 2022. In Ghana, the production of cocoa beans for 2022/23 is envisaged to overtake the level recorded during 2021/22.

The latest information indicates that the volumes of graded and sealed cocoa beans purchased in Ghana were estimated at 576,738 tonnes from October 2022 to March 2023, up by 10.1% (+53,013 tonnes) compared with 523,725 tonnes purchased during the corresponding period of the previous season.

In Brazil, the cocoa production data published by AIPC indicated that, over the first six months of the 2022/23 cocoa season, the Brazilian cocoa crop output reached 79,313 tonnes, up by 9% year-on-year (+ 6,286 tonnes) compared to 73,027 tonnes.

The current year-on-year reduction of 137,000 tonnes in cumulative arrivals in Côte d’Ivoire combined with the year-on-year increase of 53,013 tonnes in Ghana and 6,286 tonnes in Brazil results in a shortfall of 77,701 tonnes of cocoa beans. This decline represents a larger reduction of over seven times the year-on-year decline of 10,672 tonnes observed in grindings for the three main regional cocoa associations during the first half of the 2022/23 cocoa year.

Futures price developments

The global cocoa market was generally bullish in April with prices of the front-month cocoa futures contract reaching a 6-year high on both the London and New York markets at US$2,831 per tonne and US$3,218 per tonne respectively.

Figure 2 shows price movements of the first and second positions on the London and New York futures markets respectively at the London closing time in April 2023, while Figure 3 presents similar information for the previous year.

In April 2023, the MAY-23 contract traded higher compared to the JUL-23 contract in New York, while in London, the difference between the two contracts under review was minimal. Indeed, prices of the first position of cocoa futures were on average higher by US$125 per tonne compared to the second position contract in New York. In London, prices of the nearby futures contract were reduced on average by US$3 per tonne, compared to those of the JUL-23 contract. A year back in April 2022, both the London and the New York markets were in a normal contango (Figure 3).

Prices of the MAY-23 contract were bolstered on both sides of the Atlantic during the month under review. In London, prices of the front-month cocoa futures contract were boosted by 5%, from US$2,630 to US$2,773 per tonne, while in New York an 11% increase from US$2,868 to US$3,177 per tonne was recorded in prices of the MAY-23 contract.

Various factors were at play in fuelling the upward trend observed in prices. On the one hand, the persisting spectrum of a global supply deficit which resulted from the currently year-on-year low level of supply of cocoa beans from West Africa contributed to triggering the price hikes. On the other hand, the abundant rains that were recorded in Côte d’Ivoire’s main cocoa-growing regions raised concerns over a possible delay of the country’s mid-crop.

Also, the excess humidity in cocoa plantations stemming from the massive rains in cocoa growing areas heightened the likelihood of a potential outbreak of the black pod disease which is detrimental to the crop.

¹ Trade statistics from Eurostat

² IHS Markit trade database