DEERFIELD, Ill. – Mondelez International, Inc. today announced it has commenced a cash tender offer (the “Tender Offer”) for up to a combined aggregate principal amount of $2,000,000,000 of its 6.500% Notes due 2040, 6.500%.

Notes due 2031, 5.375% Notes due 2020, 7.000% Notes due 2037, 6.875% Notes due 2038, 6.875% Notes due 2039, 6.500% Notes due 2017, 6.125% Notes due August 2018, 6.125% Notes due February 2018 and 4.125% Notes due 2016 (the “Notes”).

The Tender Offer is being made pursuant to, and subject to the terms and conditions in, an Offer to Purchase, dated February 23, 2015 (the “Offer to Purchase”) and related Letter of Transmittal (the “Letter of Transmittal”), which set forth a description of the terms of the Tender Offer.

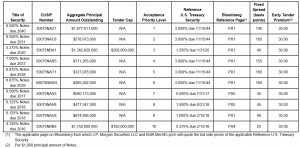

A summary of certain terms of the Tender Offer is below (click to enlarge):

The Tender Offer will expire at 11:59 p.m., Eastern time, on March 20, 2015, unless extended (such date and time, as the same may be extended, the “Expiration Time”). Holders of Notes must validly tender and not validly withdraw their Notes on or before 5:00 p.m., Eastern time, on March 6, 2015, unless extended (such date and time, as the same may be extended, the “Early Tender Deadline”) to be eligible to receive the applicable Total Consideration (as defined below) for their tendered Notes. After such time, the Notes may not be withdrawn except in certain limited circumstances where additional withdrawal rights are required by law.

Assuming the Tender Offer is not extended and the conditions to the Tender Offer are satisfied or waived, Mondelez International expects that settlement for Notes validly tendered and not validly withdrawn on or before the Early Tender Deadline will be on March 10, 2015, and that settlement for Notes validly tendered and not validly withdrawn after the Early Tender Deadline will be on March 23, 2015.

The consideration paid in the Tender Offer will be determined in the manner described in the Offer to Purchase by reference to a fixed spread over the yield to maturity of the applicable U.S. Treasury Security (the “Reference U.S. Treasury Security”) specified in the table above. Holders of Notes that are validly tendered and not validly withdrawn on or before the Early Tender Deadline and accepted for purchase will receive the applicable “Total Consideration,” which includes an early tender payment of $30.00 per $1,000 principal amount of the Notes accepted for purchase (the “Early Tender Premium”).

Holders of Notes who validly tender their Notes after the Early Tender Deadline and on or before the Expiration Time will only receive the applicable Tender Consideration per $1,000 principal amount of Notes tendered by such Holders that are accepted for purchase, which is equal to the applicable Total Consideration minus the Early Tender Premium. Holders whose Notes are accepted for purchase pursuant to the Tender Offer will also receive accrued and unpaid interest on their purchased Notes from the last interest payment date for such Notes to, but excluding, the applicable settlement date.

The Tender Offer is not conditioned upon any minimum amount of Notes being tendered, and the Tender Offer may be amended, extended, terminated or withdrawn in whole or with respect to one or more series of Notes.

The amounts of each series of Notes that are purchased on any settlement date will be determined in accordance with the acceptance priority levels specified in the table above and on the cover page of the Offer to Purchase in the column entitled “Acceptance Priority Level” (the “Acceptance Priority Level”), with 1 being the highest Acceptance Priority Level and 10 being the lowest Acceptance Priority Level.

In addition, no more than $200,000,000 aggregate principal amount of the series of Notes with Acceptance Priority Level 3 (the “Priority 3 Notes”) and no more than $100,000,000 aggregate principal amount of the series of Notes with Acceptance Priority Level 10 (the “Priority 10 Notes”) will be purchased in the Tender Offer (each such aggregate principal amount, a “Tender Cap” with respect to the applicable series of Notes).

Mondelez International will only accept for purchase Notes up to a combined aggregate principal amount of $2,000,000,000, subject to the applicable Tender Caps and Acceptance Priority Levels. Mondelez International refers to the maximum combined aggregate principal amount of Notes that may be purchased in the Tender Offer as the “Maximum Amount.”

Mondelez International reserves the right to increase or decrease the Maximum Amount, increase, decrease or eliminate any Tender Cap, or change the Acceptance Priority Level with respect to any series of Notes.

If Holders tender more Notes in the Tender Offer than they expect to be accepted for purchase by Mondelez International based on a lower Acceptance Priority Level and/or any applicable Tender Cap for the Notes being tendered, and Mondelez International subsequently accepts more than such Holders expected of such Notes tendered and not validly withdrawn on or before the Withdrawal Deadline, such Holders will not be able to withdraw any of their previously tendered Notes. Accordingly, Holders should not tender any Notes that they do not wish to be accepted for purchase.

Subject to the applicable Tender Caps, all Notes validly tendered and not validly withdrawn on or before the Early Tender Deadline having a higher Acceptance Priority Level will be accepted before any tendered Notes having a lower Acceptance Priority Level are accepted in the Tender Offer, and all Notes validly tendered after the Early Tender Deadline having a higher Acceptance Priority Level will be accepted before any Notes tendered after the Early Tender Deadline having a lower Acceptance Priority Level are accepted in the Tender Offer.

However, Notes validly tendered and not validly withdrawn at or prior to the Early Tender Deadline will be accepted for purchase in priority to other Notes tendered after the Early Tender Deadline even if such Notes tendered after the Early Tender Deadline have a higher Acceptance Priority Level than Notes tendered prior to the Early Tender Deadline.

Notes of a series subject to a Tender Cap may be subject to proration if the aggregate principal amount of the Notes of such series validly tendered and not validly withdrawn is greater than the applicable Tender Cap.

Furthermore, if purchasing all of the tendered Notes of a series of Notes of an applicable Acceptance Priority Level on any settlement date would cause the foregoing maximum amount limitation to be exceeded, the amount of that series of Notes purchased on that settlement date will be prorated based on the aggregate principal amount of that series of Notes tendered in respect of that settlement date such that the Maximum Amount limitation will not be exceeded.

Furthermore, if the Tender Offer is fully subscribed as of the Early Tender Deadline, Holders who validly tender Notes after the Early Tender Deadline will not have any of their Notes accepted for payment.

Subject to applicable law, the Tender Offer may be amended, extended, terminated or withdrawn with respect to one or more series of Notes. If the Tender Offer is terminated with respect to any series of Notes without Notes of such series being accepted for purchase, Notes of such series tendered pursuant to the Tender Offer will promptly be returned to the tendering holders.

Notes tendered pursuant to the Tender Offer and not purchased due to the priority acceptance procedures or due to proration will be returned to the tendering holders promptly following the Expiration Time or, if the Tender Offer is fully subscribed as of the Early Tender Deadline, promptly following the Early Tender Deadline.

Prior to the Initial Settlement Date, Mondelez International intends to offer and sell new debt securities. The net proceeds of the offering will be used to finance the purchase of the Notes validly tendered and accepted for purchase pursuant to the Tender Offer, and to pay all fees and expenses in connection with the Tender Offer.

Mondelez International’s obligation to accept for purchase, and to pay for, any Notes validly tendered (and not validly withdrawn) and accepted for purchase pursuant to the Tender Offer is conditioned upon the satisfaction or waiver of (i) the condition that Mondelez International receives funds in the notes offering sufficient to purchase all Notes validly tendered (and not validly withdrawn) and accepted for purchase by Mondelez International and to pay all fees and expenses in connection with the Tender Offer and (ii) the other conditions described in the Offer to Purchase under the heading “Terms of the Tender Offer—Conditions to the Tender Offer”.