LONDON, U.K. – An in-depth industry study from Market Force Information reveals the UK’s favourite places to grab a bite to eat and to stop for coffee. Five Guys Burgers and Fries has been crowned Britain’s favourite fast-food restaurant, taking top spot from last year’s winner Nando’s. In the café category, Pret A Manger was chosen as number one for the second year running.

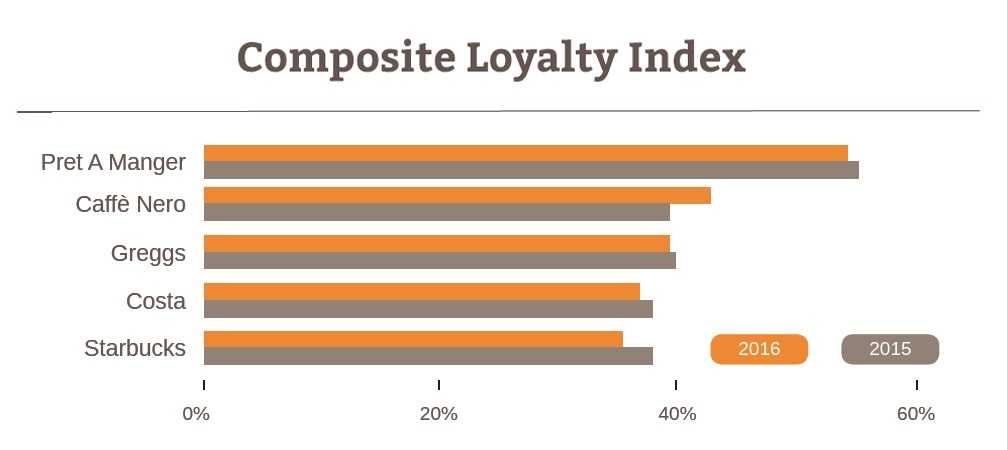

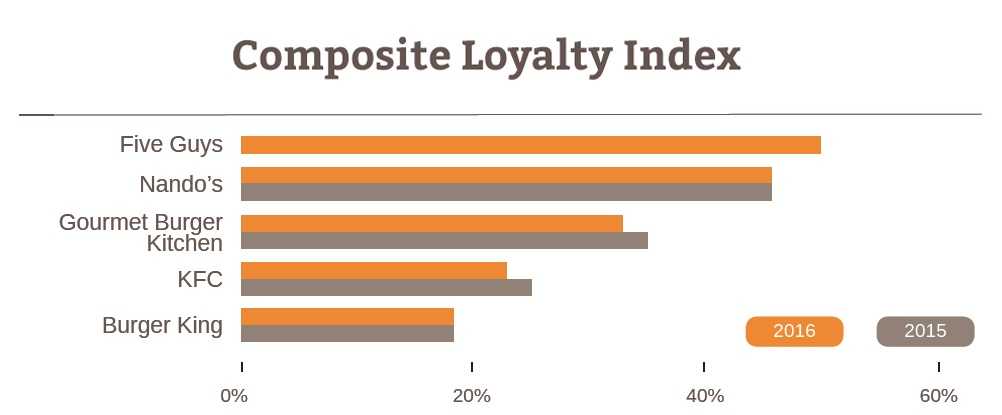

More than 4,565 UK consumers were asked to rate how satisfied their last experience at a given restaurant was and how likely they would be to recommend it to others. This data was averaged to rate each brand on a Composite Loyalty Index which benchmarks overall satisfaction and likelihood to recommend.

The Market Force study also looked at the specific attributes that drive satisfaction, analysing factors such as speed of service, food quality and value for money. With between one in five and one in eight people saying they were dissatisfied with their most recent eating out experience, this information offers insight into areas where higher levels of service can make a big difference to overall satisfaction.

Full Of Beans: Uk chooses Pret A Manger as Nation’s favourite café

Pret A Manger retained its position for a second year running, while Caffè Nero has leapfrogged Greggs into second place. Greggs is just behind however, closely followed by Costa Coffee and Starbucks. Overall, one in eight customers reported dissatisfaction with their experience in a café, revealing plenty of room for improvement.

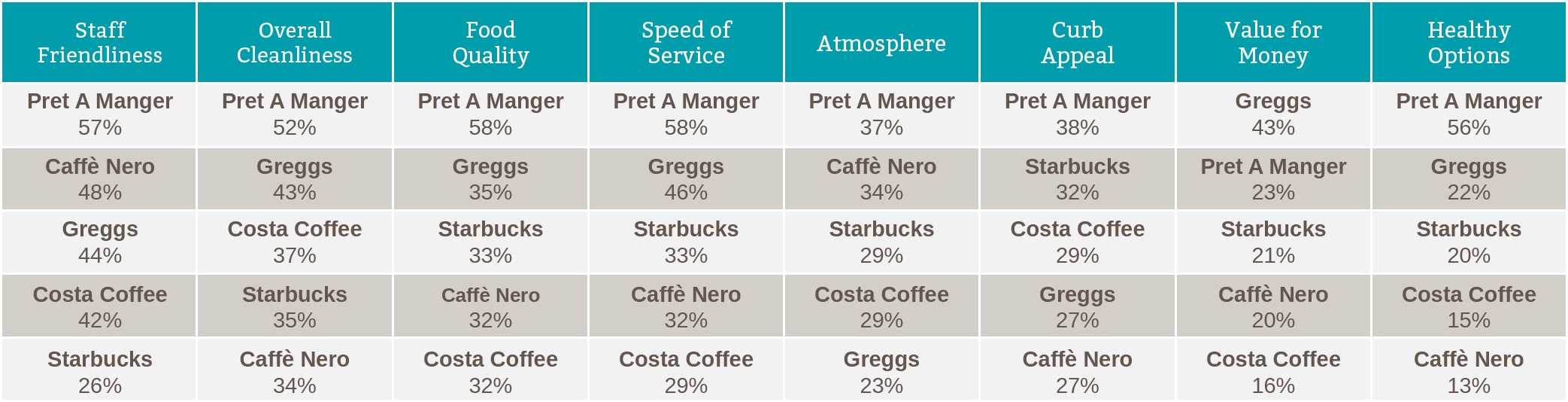

Pret A Manger reigns supreme, but Greggs offers best value for money

Consumers also rated restaurants out of five on various attributes relating to satisfaction. Pret A Manger very nearly swept the board by being rated as top in all but one category with Greggs taking top spot in the crucial value for money category. Greggs also scored well on food quality, speed and availability of healthy options, while Caffè Nero was recognised for staff friendliness and atmosphere.

Cheryl Flink, Chief Strategy Officer for Market Force Information, comments: “The popularity of speciality coffee in the UK has exploded and shows no signs of slowing. Our research shows that this sector is intensely competitive. Although Pret A Manger scores best, the other brands have very similar guest ratings and will need to focus on product quality and the service from staff to differentiate. ”

Other findings from the café category

- One in four guests visited a café at least 10 times the last 90 days and people are most likely to have visited Costa Coffee.

- Overall, just 24% of people are aware that the café they visited most recently offers a mobile app. Starbucks visitors are the most likely to be aware of its app, with 46% saying they did know about it.

- Nearly a third (31%) of people don’t know whether the café they visited offers a loyalty programme, although visitors to Caffè Nero and Costa Coffee were the most likely to be aware of such a scheme.

Grills that thrill: Five Guys Tops Burger, Steak, Chicken and Grill Category

Five Guys, which launched in the UK in 2013, has swept to success by fending off tough competition from last year’s number one Nando’s. Gourmet Burger Kitchen (GBK) placed third, followed by KFC. Overall in this category, a fifth of visitors reported an unsatisfactory experience.

Nando’s top for speed and value, but Five Guys wins on food quality and friendliness

Consumers again scored each establishment out of five on a range of attributes. While Nando’s scored the highest percentage of top marks for five out of eight attributes, exceptional performance from Five Guys in the food quality, cleanliness and staff friendliness categories was enough to earn overall success. Elsewhere, consumers recognised Gourmet Burger Kitchen (GBK) for its healthy options.

Other key findings from the burger/steak/chicken/grill category

- Customers who gave top marks to a brand in terms of satisfaction are 5.7 times more likely to recommend than those who gave a score of four out of five.

- Most guests do not report their dissatisfaction. Seven in ten guests who weren’t satisfied took no action and just 15% brought it to the attention of a member of staff.

- While all five restaurants offer a mobile app, across the board 79% of consumers didn’t know about it. Mobile app awareness was highest for GBK where half of those who visited knew it had an app, while Nando’s takes second place with 41%.

- Three-quarters of people who had visited Nando’s were aware that it offered a loyalty programme – a significantly higher figure than any of the other restaurants.

Cheryl Flink says: “The quick service restaurant category is evolving all the time, with new chains launching and arriving from overseas. Our research shows the quick traction of newcomer Five Guys – guests really appreciate the tasty burgers and think the brand offers great value.”

The Best of The Rest: Additional Findings

In addition to burgers and coffee, the research looked at four other categories: pizza, Sandwich, pub/bar and Italian.

- PizzaExpress is the UK’s favourite pizza restaurant, with Domino’s, Pizza Hut and Papa John’s just behind. The availability of healthy food options is a key area for pizza chains to differentiate.

- JD Wetherspoon has overtaken Toby Carvery as the UK’s favourite Pub / Bar eatery, although the latter is only marginally behind. In this category, food quality and availability of healthy options are the main opportunities to differentiate.

- As with cafés, Pret A Manger is top in the sandwich category, followed by Subway and Greggs.

- PizzaExpress and Prezzo shared the honours in the Italian category with Bella Italia in third and Frankie & Benny’s in fourth.

Tech-Yeah: App, digital wallet and tablet orders increase

A final area of research was into the use of technology in restaurants:

- 38% of people surveyed had used some form of technology to place orders in the last 90 days, up from 30% in 2015.

- One in seven (15%) people use mobile apps of digital wallets to pay for meals, with 30% of those aged 18-24 and 25% of those aged 25-34 the most likely to have done so. This represents a 3% increase on 2015.

Survey Demographics

The survey was conducted online in January 2016 across the United Kingdom. The pool of 4,565 UK consumers reflects a broad spectrum of income levels, with 21 per cent reporting a household income of more than £50,000 a year.

Approximately 68 per cent were women and 32 per cent were men and represented a broad spectrum of age groups.

Follow Market Force’s Restaurant Insights LinkedIn page for the latest insights, timely discussions, commentary and industry news.