MILAN, Italy – The Board of Directors of Autogrill S.p.A has reviewed and approved the consolidated results at 31 December 2018, including the consolidated Non Financial Information Declaration 2018.

Gianmario Tondato Da Ruos, Group CEO, said: “In 2017 and 2018 we worked hard to strengthen our business footprint and improve efficiency. In 2019 we have started harvesting the benefits of the work done and we will deliver on our the three-year plan, whose pillars are top line growth, structural efficiencies and profitability enhancement, as well as making bolt-on acquisitions in core geographies and rationalizing non-core activities.”

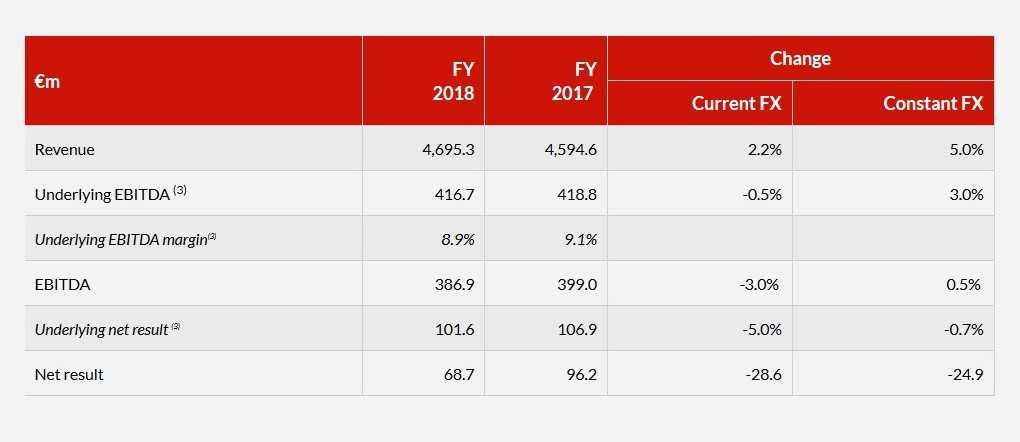

Summary of Results

- Revenue up 5.0% to €4.7 billion[1]

- Robust like for like revenue growth of +3.5%, with a positive contribution from all regions[2]

- Strong performance at airports, with revenue up 7.2%1 (+5.6% like for like)

- Underlying[3] EBITDA of €416.7m, 8.9% on revenue (€418.8m in FY2017, 9.1% on revenue), overall profitability levels maintained, despite a tough start to the year

- Underlying3 net result of €101.6m (FY2017: €106.9m)

- Net result: €68.7m, after “cross-generational deal” (Italy), other efficiency projects and other items including acquisition fees (FY2017: €96.2m)

- New contracts and renewals worth €4.1 billion[4] in FY2018

- Acquisition of Le CroBag in February 2018, with over 100 points of sale at German railway stations, and convenience retail operator Avila in August 2018, operating 25 stores at 4 US airports

- Proposed dividend of €0.20, gross of any applicable withholding tax, per share (€0.19 in 2017, +5.3%)

Outlook

2019 has started in line with expectations, with a good revenue growth in North America and International and stable revenue in Europe.

[1] At constant exchange rates. Average €/$ FX rates:

FY 2018: 1.1810

FY 2017: 1.1297

[2] The change in like for like revenue is calculated by excluding from revenue at constant exchange rates the impact of new openings, closings, acquisitions and disposals. Please refer to “Definitions” for the detailed calculation.

[3] Underlying: an alternative performance measure calculated by excluding certain revenue or cost items in order to improve the interpretation of the Group’s normalized profitability for the period. Please refer to “Definitions” for the detailed calculation.

[4] Total value of contracts calculated as the sum of expected revenue from each throughout its duration. Also includes contracts held by equity-consolidated Group companies.