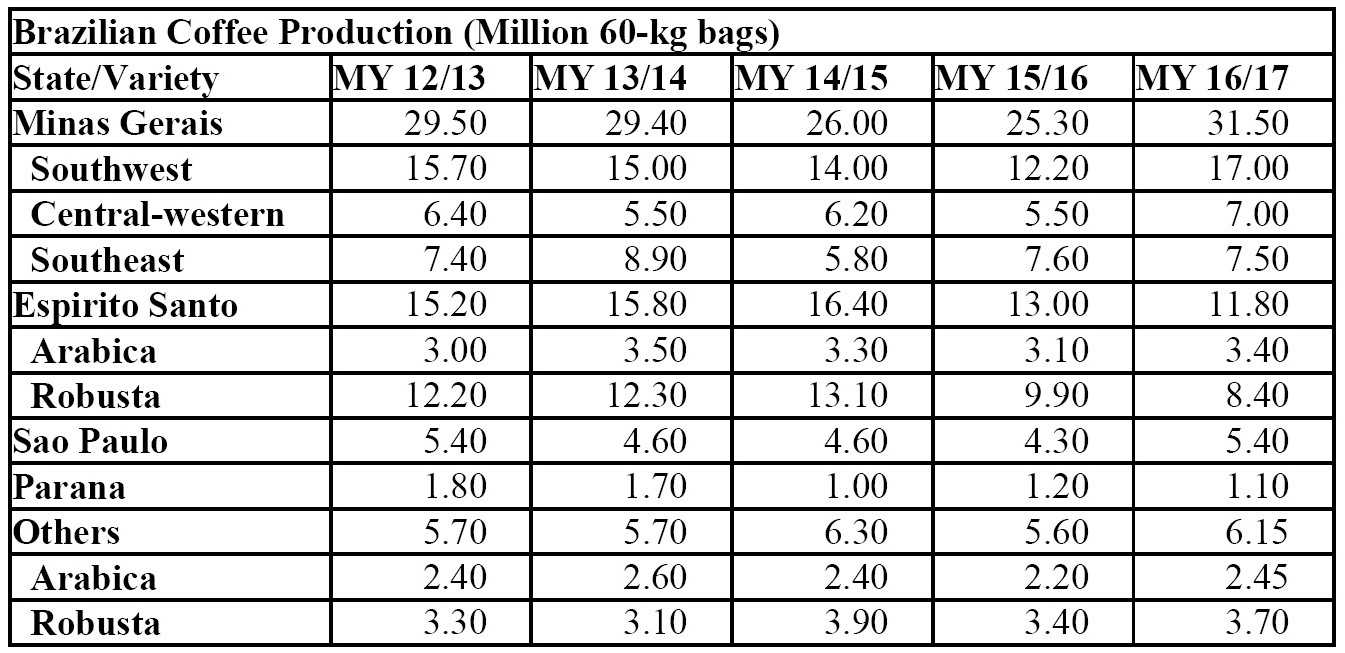

In its Coffee Annual Report, the Agricultural Trade Office in Sao Paulo (ATO) projects marketing year (MY) 2016/2017 (July-June) Brazilian coffee production at 55.95 million bags (60 kilograms per bag), green equivalent, up 6.55 million bags relative to unchanged estimate for MY 2015/16.

Post conducted field trips to major coffee producing areas (Minas Gerais, Espirito Santo, Sao Paulo and Parana) to observe vegetative development, cherry set, and fruit formation to assess the 2016 crop.

Information was also collected from government sources, state secretariats of agriculture, grower associations, cooperatives, and traders. Arabica production for MY 2016/17 is forecast at 43.85 million bags, up 21 percent compared to the previous crop.

Good blossoming between September and November 2015 in all producing regions and overall good weather conditions during fruit setting and development are likely to contribute to expected better agricultural yields compared to previous season.

Indeed, production numbers could even improve along the harvest due to expected above average de-husking yields and quality of the beans (larger screen size).

Robusta production for MY 2016/17 is, however, expected to decrease during the second consecutive year reaching 12.1 million bags, down 1.2 million bags from MY 2015/16.

Above average temperatures and prolonged dry spells in Espirito Santo will again jeopardize production potential in the state.

In addition, water shortages remains an issue for the state, thus limiting the use of irrigation on coffee plantations, a practice that is common within the state.

Harvest in the robusta producing regions began in March/April, whereas Arabica coffee harvest kicks into gear in May.

It is expected that roughly 7 to 8 million bags of washed arabica coffee will be harvested in 2016 as Brazil gained some international market share from Colombian and Central American coffee beans.

In January 2016, the Brazilian Government (GOB), through the Ministry of Agriculture, Livestock and Food Supply’s (MAPA) National Supply Company (CONAB), released its first survey projecting Brazilian coffee production in MY 2016/17.

It forecasted between 49.12 and 51.94 million 60-kg bags of production, a 5.89 to 8.71 million bag increase compared to the final estimate for MY 2015/16 (43.23 million bags – 32.04 and 11.18 million bags of arabica and robusta coffee, respectively).

CONAB projects arabica production between 37.73 and 39.86 million bags, whereas the robusta crop is estimated between 11.38 and 12.07 million bags. CONAB is expected to release the second coffee survey for the 2016 crop in May.

Coffee inventory and total area planted to coffee is projected stable for MY 2016/17.

The Brazilian coffee yield for MY 2016/17 is projected at 27.03 bags/hectare (ha), a 13 percent increase relative to the previous crop (23.86 bags/ha.). Higher Arabica tree yields should offset expected losses in production from robusta coffee.

Consumption

ATO/Sao Paulo projects Brazilian domestic coffee consumption for MY 2016/17 will be stable at 20.51 million coffee bags (19.4 million bags of roast/ground and 1.11 million bags of soluble coffee, respectively), vis-à-vis MY 2015/16, reflecting the slowdown of the Brazilian economy and changing consumer patterns, in spite the high penetration of coffee in Brazilian households.

The Brazilian Coffee Industry Association (ABIC) reports that the coffee industry processed 20.51 million bags, green equivalent, from November 2014 to October 2015, up roughly one percent compared to the same period the previous year (20.33 million bags).

Per capita consumption for 2015 is estimated at 4.90 kg of roasted coffee per person, similar to previous year (4.89 kg/person).

Total sales in the domestic market are estimated at R$7.4 billion in 2015.

The steady devaluation of the Real encouraging Brazilian exports and lower supply of robusta coffee for roasting and blending pushed production costs up, therefore affecting final retail prices.

Indeed, the average retail price for regular coffee blends was R$16.17 per kilogram in December 2015 in the city of Sao Paulo, a 16.1 percent increase relative to the beginning of the year.

Exports

Post projects total Brazilian coffee exports for MY 2016/17 at 35.23 60-kg million bags, slightly down (770,000 bags) compared to previous season, due to expected lower carry-over stocks from MY 2015/16.

Green bean exports are forecast to account for 32 million bags, while soluble coffee exports are projected at 3.2 million bags.

ATO/Sao Paulo estimates coffee exports for MY 2015/16 at 36 million 60-kg bags, green beans, slightly down from record exports from the previous year (36.573 million bags), based on year-to-date export volumes and anticipated April-June loadings.

Green bean (arabica and robusta) exports are estimated at 32.72 million bags, whereas soluble coffee exports are estimated at 3.25 million bags.

The Real devaluated on average 43.5 percent from 2014 to 2015, which supported Brazilian arabica coffee competitiveness in international markets.

According to the April 2016 coffee trade statistics report released by the International Coffee Organization (ICO), total world coffee consumption for 2014 is estimated at 150.3 million bags, up 2.48 million bags relative to 2013. Brazil represents over one third of total world exports.

Stocks

ATO/Sao Paulo forecasts total ending stocks in MY 2016/17 at 2.53 million bags, slightly up compared to the previous season (2.255 million bags), however at historically low levels. CONAB coffee stocks in March 31 are reported at 1.33 million bags.

The 2016 CONAB privately-owned stocks survey has not yet been released. The survey includes coffee stocks held by growers, coffee cooperatives, exporters, roasters, and the soluble industry as of March 31st.

Policy

On March 31, 2016, the National Monetary Council (CMN) approved funds totaling R$4.6 billion to finance coffee operations during the 2016 crop. This amount represents a 15 percent increase compared to 2015.

Funds are expected to be released in May (beginning of the harvest season for Arabica) by the Coffee Defense Fund (Funcafe) through several financing institutions such as commercial banks and coffee cooperatives.

In 2015, funds were available only in August, when a significant volume had already been harvested.